当前位置:网站首页>Withdrawal of IPO application, Yunzhou intelligent "tour" of unmanned boat enterprise fails to enter the science and Technology Innovation Board

Withdrawal of IPO application, Yunzhou intelligent "tour" of unmanned boat enterprise fails to enter the science and Technology Innovation Board

2022-07-24 15:43:00 【I dark horse】

source : Straight through IPO(ID:zhitongIPO) author : Wang Fei

By 2021 year 6 month , The undistributed profit of Yunzhou intelligent is -2.05 One hundred million yuan , There is a large amount of accumulated uncovered losses .

Go through twists and turns , Yunzhou intelligent, an unmanned boat enterprise, is still unable to “ swim ” Jinke Innovation Board .

7 month 19 Sunday night , The website of Shanghai Stock Exchange shows , Yunzhou intelligent science and Technology Innovation Board IPO Change to termination status . Shanghai stock exchange , Because the issuer withdraws the listing application and the sponsor withdraws the recommendation , According to relevant regulations , The bourse terminates its examination of issuance and listing .

source : Screenshot of Shanghai Stock Exchange

The prospectus shows , Yunzhou intelligent is an unmanned boat and related service provider , We are committed to providing “ Unmanned boat +” Intelligent water solutions , Carry out dangerous work on behalf of others 、 Complicated 、 Inefficient water work .

After more than ten years of development , Yunzhou intelligence has been developed and finalized for nearly 30 An unmanned boat product , Its products and services are applied in urban waters 、 Ocean engineering 、 Public safety 、 It is widely used in defense industry and other fields .

Civil products business , Yunzhou intelligent series products have been sold all over the world 40 Multiple countries and regions , The number of customers served exceeds 500 individual , Deliver all kinds of unmanned boat products 2000 More than one .2020 year , The business income of Yunzhou intelligent civil products is 1.95 One hundred million yuan , According to the statistics of CCID consultants , It ranks first in the domestic civil unmanned boat industry .

Defense business , Yunzhou intelligent self 2014 In, it began to focus on the field of national defense science, technology and industry , Provide customers with satisfaction The overall and supporting equipment of unmanned boats with different application needs 、 Training and test appraisal support equipment 、 Key technology development and service , To undertake the 41 A national defense project , It is one of the few domestic design and development of high-performance unmanned watercraft 、 Mass production sales and service capabilities , And has entered the mass production stage of high-tech national defense industrial enterprises .

Relevant information display , Yunzhou intelligent plans to be listed on the science and Innovation Board of Shanghai Stock Exchange , To raise funds 15.50 One hundred million yuan , It is planned to be used in the construction project of small unmanned boat production base 、 Production base construction project of medium and large unmanned boats 、 Unmanned boat R & D center upgrading project 、 Marketing network and brand building project 、 Replenish working capital .

2021 year 12 month , Yunzhou intelligent listing application was accepted by Shanghai Stock Exchange . But less than a month later , The service provider it employs —— Jindu law firm was filed for investigation by the CSRC , The relevant listing review has been suspended .

This year, 2 month , Yunzhou intelligent resumed the review of issuance and listing . A little over a month later , Affected by the epidemic , Yunzhou intelligent machine intermediary failed to complete the due diligence within the specified time 、 Reply to inquiries , Smart regret applied to Shanghai stock exchange for suspension of audit . until 6 month , The Shanghai Stock Exchange has just replied to its IPO Review .

It was not long after Yunzhou intelligent replied to the first round of inquiries of the Shanghai Stock Exchange , Yunzhou intelligent finally made the decision to withdraw its listing application .

The prospectus previously submitted by Yunzhou intelligence shows ,2018-2020 Years and 2021 year 1-6 month , The operating revenues of the company are 0.27 Billion 、0.64 Billion 、2.53 And one hundred million 1.18 One hundred million yuan ; The gross profit rates of the main businesses are 42.09%、 40.62%、37.32% And 51.40%; Net profit is -0.87 Billion 、-1.20 Billion 、-1.60 Billion 、-0.37 One hundred million yuan ; Deducting the net profit not attributable to the parent company is -0.94 Billion 、-1.30 Billion 、-1.30 Eva -0.47 One hundred million yuan .

source : Yunzhou smart prospectus

By 2021 year 6 month 30 Japan , The undistributed profit of Yunzhou intelligent is -2.05 One hundred million yuan , There is a large amount of accumulated uncovered losses . Yunzhou intelligent said in the prospectus , The company may invest more resources in R & D in the future 、 Production and sales , Will face the risk of sustained losses .

According to CCID consultant data ,2020 In, the market scale of civil unmanned boats in China was 3.3 One hundred million yuan , The market segment of Yunzhou intelligence is small . For example, the future unmanned boat industry cannot continue to explore new commercial applications , Or the growth rate of market scale in existing application fields is less than expected , Yunzhou intelligence will also face the risk of limited market development space .

In addition to the small size of the market , Yunzhou intelligence inevitably faces the embarrassing situation of head customer concentration . The prospectus shows , During the reporting period , The sales amount of Yunzhou intelligent to the top five customers is 0.06 Billion 、0.21 Billion 、1.38 And one hundred million 0.81 One hundred million yuan , The proportion of the company's operating income in each corresponding period is 20.95%、32.49%、54.78% And 68.64%.2020 Years and 2021 year 1-6 month , The proportion of the company's sales revenue to the top five customers in the operating revenue exceeds 50%.

The prospectus shows , By 2021 year 6 month 30 Japan , Yunzhou intelligent has a total of authorized patents 257 And software copyright 27 term , The company's R & D team has 172 people . The cumulative R & D investment of the company in the last three years is 1.56 One hundred million yuan , The recent proportion of the accumulated operating income in the last three years is 45.58%. After excluding the equity incentive fee , The cumulative R & D investment in the past three years is 1.01 One hundred million yuan , The proportion in the accumulated operating revenue of the last three years is 29.32%.

It is worth noting that , During the reporting period , The proportion of R & D investment of Yunzhou intelligence in operating revenue basically shows a downward trend year by year ,2018 Up to 113.70%, and 2021 year 1-6 Month only 29.86%.

Disclosure of information , Yunzhou intelligent has completed several rounds of financing before , Investors include Zhenge Fund 、 Investment capital 、 Zhencheng investment 、 Yuanxing capital, etc .

The prospectus shows , The largest shareholder of Yunzhou intelligence is the company's founder 、 The chairman and CEO Zhang Yunfei , The shareholding ratio is up to 22.49%; Cheng Liang, co-founder of Yunzhou intelligence, holds shares 10.22%; Zhuhai Yunzhou people hold 6.00%; Huajin Lingyue holds shares of 5.38.

source : Yunzhou smart prospectus

It is worth mentioning that , Yunzhou intelligent Angel round investor Zhenge fund holds shares 2.25%, Wang Changtian, the actual controller of ray media, also owns the company 0.05% shares .

边栏推荐

- kubernetes GPU的困境和破局

- 三、集合基础——ArrayList集合与简单学生管理系统

- Kubernetes version docking object storage

- 【洛谷】P1908 逆序对

- Sklearn.metrics module model evaluation function

- faster-rcnn 训练自己的数据集

- 在LAMP架构中部署Zabbix监控系统及邮件报警机制

- Analysis of some difficulties in VAE (variational self encoder)

- Error in anyjson setup command: use_ 2to3 is invalid.

- 【TA-霜狼_may-《百人计划》】图形3.4 延迟渲染管线介绍

猜你喜欢

![[SWT] scrolling container to realize commodity list style](/img/84/07e7c794aaef3fb64f173b50150b21.png)

[SWT] scrolling container to realize commodity list style

MATLAB image defogging technology GUI interface - global balance histogram

Automatic derivation of pytorch

kubernetes多网卡方案之Multus_CNI部署和基本使用

Dynamics crm: mailbox configuration (III) - configure email server profiles and mailboxes

VAE(变分自编码器)的一些难点分析

Leetcode 231. 2 的幂

Error: pidfile (celerybeat.pid) already exists when celery starts beat

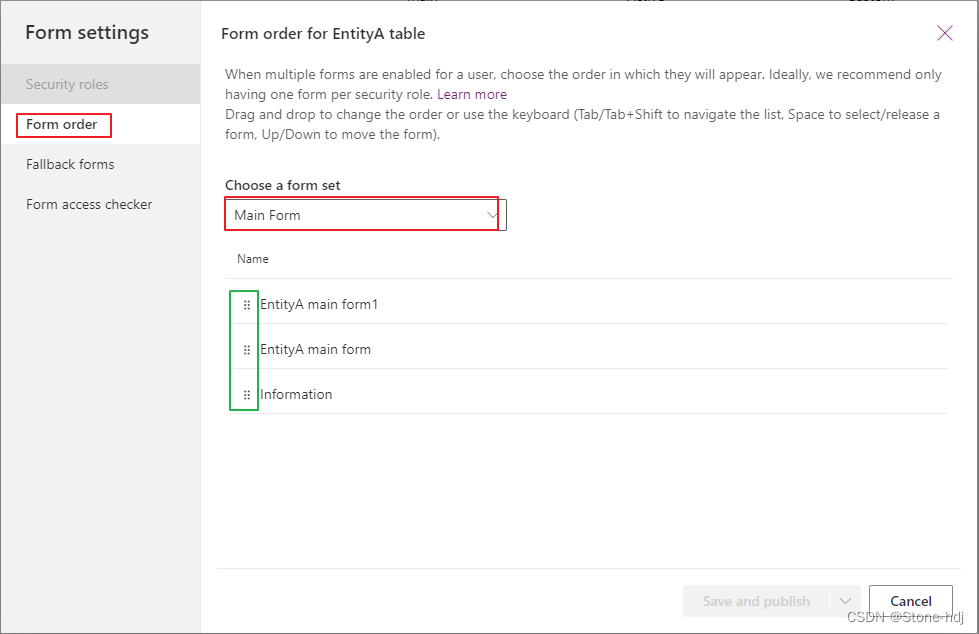

Dynamics crm: how to set the order of forms

JUC source code learning note 3 - AQS waiting queue and cyclicbarrier, BlockingQueue

随机推荐

Dynamics crm: how to set the order of forms

AttributeError: module ‘seaborn‘ has no attribute ‘histplot‘

Lsyncd set up synchronous image - use lsyncd to realize real-time synchronization between local and remote servers

What is the ranking of good securities companies? Is online account opening safe

【SWT】自定义数据表格

2022 RoboCom 世界机器人开发者大赛-本科组(省赛)-- 第三题 跑团机器人 (已完结)

Exomiser对外显子组变体进行注释和优先排序

You are only one SQL statement away from the tdengine Developer Conference!

Kubernetes GPU's Dilemma and failure

【量化测试】

在LAMP架构中部署Zabbix监控系统及邮件报警机制

降噪蓝牙耳机哪个好?性价比最高的降噪蓝牙耳机排行

[machine learning basics] - another perspective to explain SVM

Istio1.12: installation and quick start

Memorythrashing: Tiktok live broadcast to solve memory dithering practice

有了这个机器学习画图神器,论文、博客都可以事半功倍了!

Dynamics crm: sharing records for users and teams

mysql源码分析——索引的数据结构

Which is a good noise reduction Bluetooth headset? Ranking of the most cost-effective noise reduction Bluetooth headsets

Deploy ZABBIX monitoring system and email alarm mechanism in lamp architecture

Anonymous users

Anonymous users