当前位置:网站首页>Technical operation

Technical operation

2022-07-24 23:44:00 【Singularity imagination】

Buy some technical index series 《 One 》

You can read classic books . 《 Stock wizard 》 The first 6 Chapter , The first 7 Chapter . 《100 Times super strong stocks 》 The first 9 Chapter .

Performance catalysis

Buying time node : After the results are disclosed , The next day, the index of whether to get on the train is carried out in combination with the volume and price behavior .

Performance forecast or disclosure , Performance is increased in advance or exceeds expectations , Opening the next day , Stock prices often jump short and open higher in the form of profit fault . Form buying points that can be bought or increased , But there are rules for this kind of buying , The law of quantity ratio for short .

The law of quantity ratio : Directly in app Client view ratio index , It is a linear relationship between the opening time and the volume ratio as the rule of whether to buy .

The relationship is shown in the table below :

| Opening time (mins) | Volume ratio ( critical value ) |

|---|---|

| 5 minute | Greater than 10 |

| 15 minute | Greater than 6 |

| 30 minute | Greater than 4 |

| 60 minute | Greater than 3 |

The above time nodes and volume ratios are used as the test value for the effectiveness of performance catalysis , Of course, it should also be combined with the increase of share price , If the increase 5 You can buy it within a point , Radical leeks themselves according to their own situation quantitative increase threshold .

Tips : Generally, the success of performance catalysis conforms to the above volume ratio relationship , After the share price rises , There will be stepping back on the time-sharing chart , If you miss the opening, buy some , You can get on the bus when you step back on the isochronous map .

Example : Harmony 2021 year 07 month 05 Friday night , Forecast performance increase (55% - 75%), 2021 year 07 month 06 Day in the morning , Performance is catalysed , With 3.10% The increase is higher , At the same time, the volume ratio index reached 14.426, Far more than the above standard value , Finally, the stock price withstood the decline of the market that day 1.78% Range of , The day bucked the trend and closed up 7.99% . Is an effective performance catalyst .

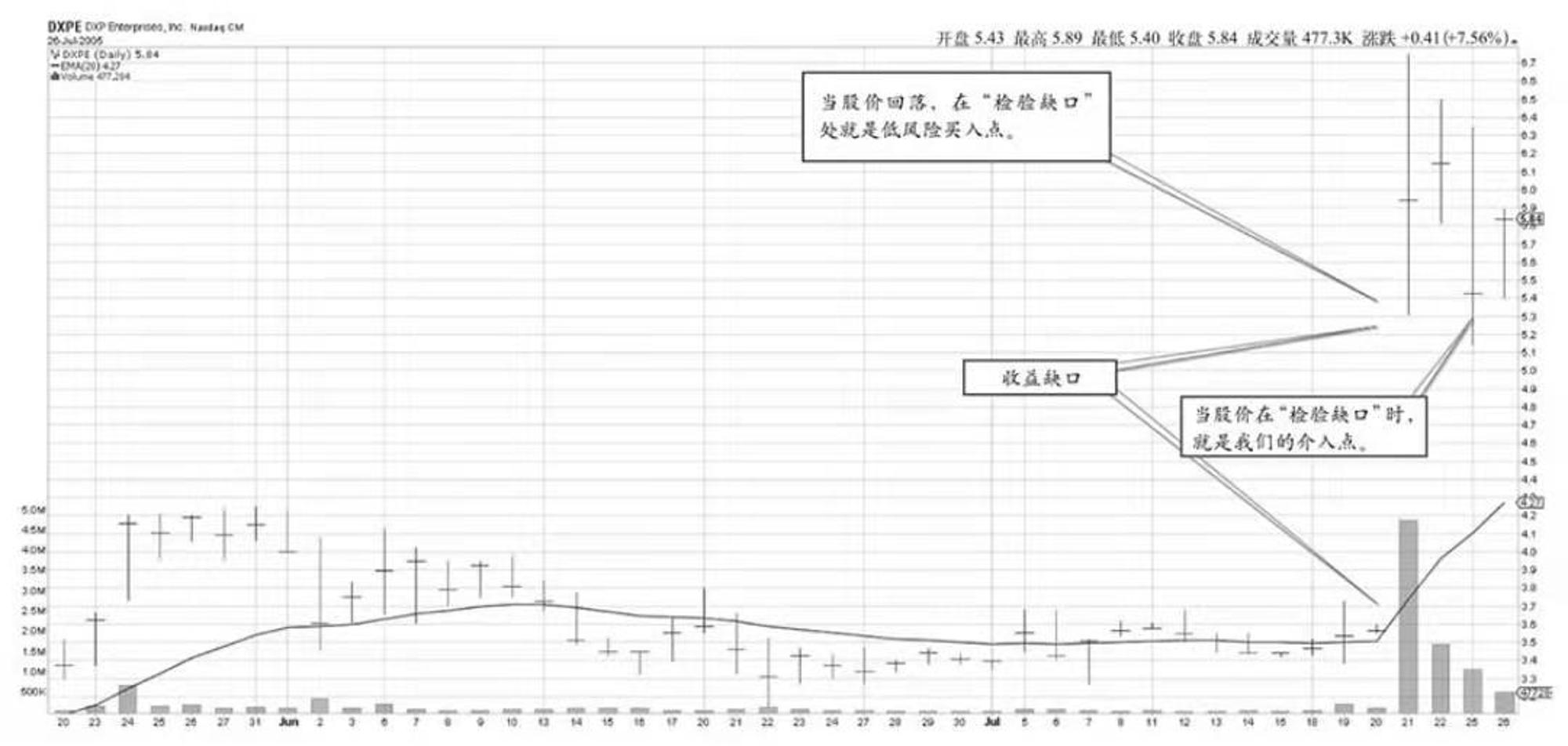

Net profit fault method

The power of the net profit fault model is infinite .

Into the eyes of the law : Performance exceeding expectations , There is a gap in the opening price , The closing price stood firm 7% above , Standing above the important average ,10 DMA、20 DMA、50 DMA、200 DMA. If it is not directly sealed , There will be signs of both volume and price rising . Understand the profound meaning : Faults generally have improved fundamentals 、 Or change , To return to fundamental research , Only in this way can we truly understand whether the surplus afterwave is caused after the fault . Gap verification : Post fault , After several weeks to a month of steady adjustment , Adjustment period , The trading price amplitude will narrow , The narrower the amplitude, the better , The best thing is that the closing price for a few days is equal to the opening price , And the trading volume continues to shrink . Treat dialectically : Everything has two sides , Profit and loss are the same , We need to look at this model dialectically , Don't get on the bus blindly . This rule only increases the probability of successful trading .

After the listed company announced that its profits exceeded expectations , Most strong stocks will rise “ Jump gap ”, Investors call this phenomenon “ Break through the gap ” or “ Income gap ”.

After the profit announcement , The fundamentals of the stock have improved significantly , The gap formed after the closing of the short trading price is not so much a technical support , Rather, it is a fundamental support , Investors who know the inside story will firmly hold this gap .2 ~ 3 Week is a safe time to buy , In this buying cycle , Super trend stocks will continue to show a quiet period for several weeks , At the same time, the trading volume will continue to decline .

Verify the gap , The stock price will jump back to the opening price when the results are released that day , The date of occurrence may be , The... After the release of performance 2 God 、 The first 5 God 、 The first 10 God , I'm not sure , Just track . If you have been pulling up after jumping, there is no callback verification , At this time, you need to give up , Because I didn't buy some .

key word , Surplus aftershocks .

Case diagram

Case a : Quanzhi Technology , Quanzhi Technology 2021 After the first quarter results are released , Jump the limit and close , At the same time, the number of achievements has increased dramatically . After weeks of turbulence , Share price volatility narrowed , At the same time, the trading volume shrank , The transaction price stepped back on the verification gap , This is a good time to enter , Subsequent share price increases 100 % above .

Case 2 : By health . 2021 year 3 month 8 Japan , After the announcement of Tomson Beijian's performance , Directly jump the daily limit and close , There is almost no shock verification gap in the transaction price in the following week , Increase in the following month 40% above .

Magic support line (50 ma or 10 Weeks average ) And others 4 Low risk moving average

Magical support line :50 Japan DMA or 10 Weeks average , To wash the dishes , You may see the stock price in 50 Below the daily average 5% ~ 10% For several days , however , If the stock is 50 It takes more than 1 ~ 2 Zhou , There is a great chance that there is no hope of continuing to rise .

The organization will be in 50 Build positions on a large scale , At the same time, good news is always released when the stock price touches the magic support line , It's no coincidence , But Yang Mou .

Case diagram

Four low-risk moving averages :

The first is 10 Daily moving average . The second is 20 Daily moving average . Article 3 is 50 Daily moving average or 10 Weeks average The fourth is 200 Daily moving average and 20/30 Weeks average .

If the stock price rises very much in the short term , If you are optimistic about the stock 10 DMA It is often the best opportunity to enter . once 10 DMA Loss of support , It's your turn 20 DMA Debut .

Strong 20 DMA It may last for months , If the stock transaction price is generally at 20 DMA below , Just wait 50 DMA The arrival of the .

50 DMA or 10 Weekly moving average is the safest moving average buying point , Many stocks will be sideways at the bottom , until 50 DMA There is an upward trend . There are also many stock transaction prices that have been above these averages , Its share price may fall sharply in the future , Touch the rising 50 DMA or 10 The weekly average will stop .

Long term investment technical indicators , Most stocks that have been rising for a long time will touch 200 DMA 、20 Weeks average 、30 Long moving average such as weekly average , If you plan to invest for a long time , When share prices hit such long-term averages , It's a safe entry or position increase point .

Step back to buy

If a stock is bought in the rising stage , Share prices may continue to rise , It is also possible to turn around and go down , The probability of 50 :50 . But if you buy in the climbing stage after the stock price correction , The odds of winning will be greater .

The volume has shrunk , Buy when the share price fluctuates in a narrow range (BLT) There is little difference between the opening price and the closing price ( Narrow fluctuation ), When the trading volume is light , It is often safe to buy something .

After both volume and price rise , Good stocks tend to enter a period of adjustment that lasts for several weeks , Only after the huge reduction of trading volume , It's a buying opportunity .

Case diagram

Stock prices buy early in the rise ( Pocket pivot method )

The later series of articles introduces , Coming soon

Completed on 2021 year 7 month 11 Japan 16:31:26

Scan the QR code below , Official account , The content is more wonderful

Search official account : Singularity imagination

边栏推荐

- Development direction and problems of optaplanner

- Are you still using system. Currenttimemillis()? Take a look at stopwatch

- Introduction to HLS programming

- How to speculate on the Internet? Is it safe to speculate on mobile phones

- QDir类的使用 以及部分解释

- Add a little surprise to life and be a prototype designer of creative life -- sharing with X contestants in the programming challenge

- Mandatory interview questions: 1. shallow copy and deep copy_ Deep copy

- Pointrender parsing

- Piziheng embedded: the method of making source code into lib Library under MCU Xpress IDE and its difference with IAR and MDK

- 生成式对抗网络的效果评估

猜你喜欢

高阶产品如何提出有效解决方案?(1方法论+2案例+1清单)

Architecture design of multi live shopping mall

Convex optimization Basics

Implementation of cat and dog data set classification experiment based on tensorflow and keras convolutional neural network

Go basic notes_ 4_ map

Only by learning these JMeter plug-ins can we design complex performance test scenarios

Are you still using system. Currenttimemillis()? Take a look at stopwatch

Let me introduce you to the partition automatic management of data warehouse

Notes of Teacher Li Hongyi's 2020 in-depth learning series 2

Network Security Learning (III) basic DOS commands

随机推荐

JDBC 驱动升级到 Version 8.0.28 连接 MySQL 的踩坑记录

Notes of Teacher Li Hongyi's 2020 in-depth learning series 4

ShardingSphere-数据库分库分表简介

Network Security Learning (IV) user and group management, NTFS

In pgplsql: = and=

[zero basis] SQL injection for PHP code audit

SQL rewriting Series 6: predicate derivation

dpkg : Breaks: libapt-pkg5.0 (< 1.7~b) but 1.6.15 is to be installedE: Broken packages

Go基础笔记_4_map

Salesforce zero foundation learning (116) workflow - & gt; On flow

Use and partial explanation of QDIR class

Network Security Learning (II) IP address

采坑记录:TypeError: 'module' object is not callable

常用在线测试工具集合

Zheng Huijuan: Research on application scenarios and evaluation methods of data assets based on the unified market

NVIDIA inspector detailed instructions

Bug summary

Introduction to HLS programming

Opengauss kernel analysis: query rewriting

QDir类的使用 以及部分解释