当前位置:网站首页>deep learning statistical arbitrage

deep learning statistical arbitrage

2022-06-27 10:31:00 【SyncStudy】

deep learning statistical arbitrage

- empirial

- stanford

- Jorge guijarro

- markus

Motivation

- Pair trading

- GM and Ford

- Assumption

- prices are on average similar

- Exploit temporal price different between similiar seests

Three components of statisical arbitarge

- contrict protolio

- trading signal

Foundational problem

Research question

- arbitrage portolios

- arbitarge signals

Contributions

- Novel conceptual framework

- Unified framework

- To compare different statistical arbitrage methods

- Portolio generation

- signal extraction

- allocation decision

- Study each component and compare with conventional models

Novel methods

- statistical factor

- Convolution neural network

Empirical

- substantially outperforms

- sharpe ratios

Parametric models

- PCA

- cOINTEGRATION

- STOCHASTIC CONTROL

- SIMPLE PAIRS TRADING

- INTRACTABLE PARAMETRIC MODELS WITH ml

Model

R n , t = β n , t − 1 T F t + ε R_{n,t}=\beta^T_{n,t-1}F_t+\varepsilon Rn,t=βn,t−1TFt+ε

x : = ε t L : = ( ε n , t − L ) x:=\varepsilon_t^L:=(\varepsilon_{n,t-L}) x:=εtL:=(εn,t−L)

w t − 1 ε = w ε ( θ ( ε t − 1 L ) ) w_{t-1}^\varepsilon=w^\varepsilon(\theta(\varepsilon_{t-1}^L)) wt−1ε=wε(θ(εt−1L))

w t − 1 R = w_{t-1}^R=\frac{}{} wt−1R=

d X t = κ ( μ − X t ) dX_t = \kappa(\mu-X_t) dXt=κ(μ−Xt)

θ i = ∑ j = 1 L W j f i l t e r X j \theta_i=\sum_{j=1}^{L}W_j^{filter}X_j θi=j=1∑LWjfilterXj

W W^{} W

θ C N N + T r a n s ( X ) \theta^{CNN+Trans}(X) θCNN+Trans(X)

y I ( 0 ) = ∑ m = 1 D s i z e W m l o c a l X y_I^{(0)}=\sum_{m=1}^{D_{size}}W_m^{local}X yI(0)=m=1∑DsizeWmlocalX

h i = ∑ I = 1 L α i , I x I ~ h_i=\sum_{I=1}^{L}\alpha_i,I\widetilde{x_I} hi=I=1∑Lαi,IxI

F a m a − F r e n c h F a c t o r Fama-French Factor Fama−FrenchFactor

C N N + T r a n s f o r m CNN+Transform CNN+Transform

α , t α , R 2 \alpha, t_\alpha,R^2 α,tα,R2

t μ t_\mu tμ

w t − 1 = w t − 1 w_{t-1}=\frac{w_{t-1}^{}}{} wt−1=wt−1

L = 60 L=60 L=60

F F N FFN FFN

< 1 % <1\% <1%

T t r a i n = 4 T_{train}=4 Ttrain=4

f a s t − r e v e r s a l fast-reversal fast−reversal

- fast reversal

- early momemtum

- low frequency downturn

- low frequency momentum

- smooth trends or local curvature

- most recent 14 days get more attention for trading decision

- more complex than simple reversal patterns

c o s t ( w t − 1 R , w t − 2 R ) = 0.0005 ∣ ∣ w t − 1 cost(w_{t-1}^R, w_{t-2}^R)=0.0005||w_{t-1} cost(wt−1R,wt−2R)=0.0005∣∣wt−1

B = 7 B=7 B=7

S R = 1 SR=1 SR=1

a r b i t r a g e arbitrage arbitrage

m e a n mean mean

Δ P = P 2 − P 1 \Delta P=P_2-P_1 ΔP=P2−P1

V = ∑ V=\sum V=∑

V = ∣ β 0 + β 1 Δ P ∣ V=|\beta_0+\beta_1\Delta P| V=∣β0+β1ΔP∣

β 0 = c ( μ A − μ B ) \beta_0=c(\mu_A-\mu_B) β0=c(μA−μB)

β 1 = f ( r i s k ) \beta_1=f(risk) β1=f(risk)

E ( V ) = E [ ∣ β 0 + β 1 σ P Z ∣ ] E(V)=E[|\beta_0+\beta_{1\sigma P}Z|] E(V)=E[∣β0+β1σPZ∣]

Z Z Z

N ( 0 , 1 ) N(0,1) N(0,1)

E ( V ) = c o n s t a n t E(V)=constant E(V)=constant

1 1 + ϕ ( h ∣ β 0 ∣ β 1 ) \frac{1}{1+\phi (\frac{h|\beta_0|}{\beta_1})} 1+ϕ(β1h∣β0∣)1

K > S T K>S_T K>ST

K ≤ S τ K \le S_\tau K≤Sτ

K − S τ K-S_\tau K−Sτ

K > S 0 , k = S 0 K>S_0, k=S_0 K>S0,k=S0

m o n e y n e s s = l o g ( K S 0 ) σ τ moneyness=\frac{log(\frac{K}{S_0})}{\sigma \sqrt{\tau}} moneyness=στlog(S0K)

l o n g d a t e d = l a r g e τ long dated = large \tau longdated=largeτ

M o n e y n e s s = l o g ( K S 0 ) σ τ Moneyness = \frac{log(\frac{K}{S_0})}{\sigma\sqrt{\tau}} Moneyness=στlog(S0K)

S P X SPX SPX

3 b i l l i o n 3 billion 3billion

R V t o p t i o n = ∑ i ( r i , t o p t i o n ) 2 RV_t^{option}=\sum_i (r_{i,t}^{option})^2 RVtoption=i∑(ri,toption)2

realized variance

R V t o p t i o n = ∑ i ( r i , t o p t i o n ) 2 RV_t^{option}=\sum_i(r_{i,t}^{option})^2 RVtoption=i∑(ri,toption)2

边栏推荐

- Multi thread implementation rewrites run (), how to inject and use mapper file to operate database

- 嵌入式软件架构设计-模块化

- 并发,并行,异步,同步,多线程,互斥的概念

- 如何在 Methodot 中部署 JupyterLab?

- [tcapulusdb knowledge base] tcapulusdb Model Management Introduction

- Error im002 when Oracle connects to MySQL

- [cloud enjoys freshness] community weekly · vol.68- Huawei cloud recruits partners in the field of industrial intelligence to provide strong support + business realization

- Working at home is more tiring than going to work at the company| Community essay solicitation

- Explain the imaging principle of various optical instruments in detail

- [noodle classic] Yunze Technology

猜你喜欢

Mail system (based on SMTP protocol and POP3 protocol -c language implementation)

【TcaplusDB知识库】Tmonitor单机安装指引介绍(二)

【HCIE-RS复习思维导图】- STP

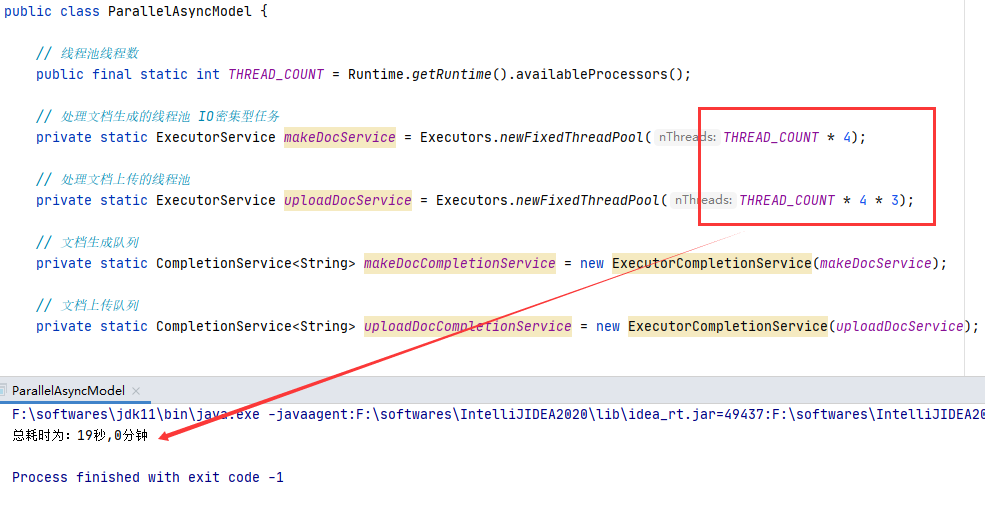

Future & CompletionService

What basic functions are required for live e-commerce application development? What is the future development prospect?

用户认证技术

Audiotrack and audiolinker

![leetcode:522. Longest special sequence II [greed + subsequence judgment]](/img/43/9b17e9cb5fee9d14c2986a2141889d.png)

leetcode:522. Longest special sequence II [greed + subsequence judgment]

CPU设计(单周期和流水线)

21:第三章:开发通行证服务:4:进一步完善【发送短信,接口】;(在【发送短信,接口】中,调用阿里云短信服务和redis服务;一种设计思想:BaseController;)

随机推荐

CPU design (single cycle and pipeline)

go-zero微服务实战系列(七、请求量这么高该如何优化)

C语言学习-Day_05

Mongodb cross host database copy and common commands

【TcaplusDB知识库】Tmonitor单机安装指引介绍(一)

导师邀请你继续跟他读博,你会不会立马答应?

Mail system (based on SMTP protocol and POP3 protocol -c language implementation)

Ci/cd automatic test_ 16 best practices for CI / CD pipeline to accelerate test automation

User authentication technology

堆-堆排序-TopK

C language learning day_ 05

2-4 installation of Nessus under Kali

Frequently asked questions about closures

以后发现漏洞,禁止告诉中国!

学习笔记之——数据集的生成

C any() and aii() methods

Win10 shortcut key sorting

Go zero micro Service Practice Series (VII. How to optimize such a high demand)

红包雨: Redis 和 Lua 的奇妙邂逅

unity shadow 和outline组件动态加载出错解决方案、问题深入分析