当前位置:网站首页>The largest IPO of Hong Kong stocks this year, with a net worth of 66billion, is the "King" sitting on the mine

The largest IPO of Hong Kong stocks this year, with a net worth of 66billion, is the "King" sitting on the mine

2022-06-23 14:43:00 【I dark horse】

This company will open the largest stock market in Hong Kong this year IPO.

author : Miku

edit : Jiulu

Hong Kong is the largest city this year IPO We're going to have .

i Black horse learned ,6 month 19 Japan , Tianqi lithium has passed the listing hearing of Hong Kong stock exchange . This time IPO plan , Tianqi lithium is considering raising 10 Million to 12 Billion dollars , With 10 The financing scale of US $billion is calculated , This will be the largest since the Hong Kong stock exchange this year IPO, After the listing , Tianqi lithium will also become a company listed on Shenzhen Stock Exchange and Hong Kong stock exchange .

Behind Tianqi lithium industry , He is a man who has been in business for a long time “ veteran ”. Jiangweiping, the founder of the company 1955 Born in , Experienced the movement of going up the mountain to the countryside , It has also become the first group of people to go to university after the resumption of the college entrance examination .1997 year , He gave up his iron rice bowl , Start your own business , Engaged in lithium import and export business .2004 year , A lithium salt plant in Suining, Sichuan, is on the verge of bankruptcy , Jiangweiping therefore acquired and founded Tianqi lithium . Starting from a small factory on the verge of bankruptcy , Tianqi lithium has used 18 Years to build a “ Lithium Kingdom ”.

The success of Tianqi lithium , It is the epitome of Chinese enterprises' efforts to overcome the bottleneck problem . Ganfeng lithium industry 、 Ningde era 、 Hive energy …… More and more excellent companies are acquiring overseas 、 Technology research and development 、 Mode innovation and other means , Break the western technological monopoly , They represent that Chinese business is entering “ Hard technology era ”.

01

Sichuan fellow villagers ,

18 Create a “ Lithium Kingdom ”

Market capitalization of about 1800 Billion

Of Tianqi lithium “ Lithium Kingdom ”, It started from a small factory on the verge of closure .

1955 year , Jiangweiping was born in Sichuan , Graduated from high school , I caught up with the movement of going up the mountain to the countryside . until 1977 College entrance examination resumed in , Jiangweiping became one of the first people to enter the University .

1982 year , He graduated from Xihua University majoring in machinery , In Chengdu Machinery Factory 3 Technician in . after , Jiangweiping has been engaged in administrative work for one year .1986 year , Jiangweiping began to work as a sales engineer of China Agricultural Machinery Southwest Company , Then 11 In the year , Jiangweiping has remained in the system .

here we are 1997 year , catch up with “92 Down the tide ” The tail of the , Jiangweiping decided to give up his iron rice bowl , Started an independent business .

At the beginning of the business , Jiangweiping is mainly engaged in lithium import and export agency business . at that time , Shehong lithium salt factory, the predecessor of Tianqi lithium industry, is jiangweiping's customer , Talison, the supplier, is the holding subsidiary of Tianqi lithium , What jiangweiping did was import lithium ore from talison , Resell to Shehong lithium salt factory .

Because of the uncertainty of foreign trade itself , Plus the lack of clarity about future development , Jiangweiping has always had the idea of doing business . Final , Jiang Weiping 2003 Tianqi group was founded in , Decide to transform . soon , The opportunity came in front of jiangweiping .

Founded in 1992 In, Suining Shehong lithium salt factory suffered from a long-term market downturn 、 Product quality is not up to standard and other reasons , Insolvency ,2004 Once on the verge of bankruptcy , Become a big stone in the hearts of local government decision makers .

at that time , Lithium has not been widely used in the field of new energy , Few people pay attention to or are optimistic about the lithium resource industry .“ The government came to me to talk about taking over Shehong lithium salt factory , I didn't hesitate , On the one hand, I am interested in lithium industry , On the other hand, it is also a responsibility .” Jiangweiping recalled this experience .

2004 year , Jiangweiping purchases Shehong lithium salt plant , Tianqi lithium industry was founded on the basis of Shehong lithium salt plant .

Although I don't have much experience in running an industry , But I have been doing import and export trade for a long time , Plus the early training in the system , Let jiangweiping move in the right direction , On the one hand, invest funds to transform the equipment , Improve productivity and productivity ; On the other hand, jiangweiping started with the management mode , Introduce modern enterprise management system and concept , Tianqi lithium gradually turned losses into profits .

2010 year , Tianqi lithium was successfully listed on the Shenzhen Stock Exchange . This year , The annual revenue of Tianqi lithium is nearly 3 One hundred million yuan , Net profit is not enough 4000 Ten thousand yuan .

After the listing , With the power of capital , Tianqi lithium has opened the road of global expansion , Through successive mergers and acquisitions of a number of lithium resources and the layout of the upstream and downstream of the industrial chain of lithium raw materials , Tianqi lithium has become one of the global lithium mining giants , It also guarantees China's voice in the lithium industry .

2021 year , Jiang Weiping took 660 One hundred million people rank high in the rich list , Become the richest man in Suining, Sichuan .

Results show that , Tianqi lithium Co., Ltd 2019 year 、2020 year 、2021 The annual revenue is 48.4 One hundred million yuan 、32.39 One hundred million yuan 、76.63 One hundred million yuan ; The net profit is respectively -59.83 One hundred million yuan 、-18.34 One hundred million yuan 、20.79 One hundred million yuan . Besides , Tianqi lithium Co., Ltd 2022 The first quarter of the year's revenue was 52.57 One hundred million yuan , year-over-year 9 Billion growth 481.41%; The net profit attributable to the shareholders of the listed company is 33.28 Billion , Net loss in the same period of last year 2.48 One hundred million yuan .

Now , Jiangweiping's entrepreneurial journey has ushered in another milestone —— Tianqi lithium passed the listing hearing of HKEx , Planned financing 10 Million to 12 Billion dollars , It will become the largest exchange in Hong Kong this year IPO.

02

Two snakebites “ The war ”

Tianqi lithium industry controls the development of lithium mine “ Throat ”

First listed on Shenzhen Stock Exchange , Later, it was successfully listed on the Hong Kong stock exchange , Why should Tianqi lithium ?

We can talk about the acquisition history of Tianqi lithium .

2008 year , Deep ploughing 4 After the lithium ore processing industry in , Jiangweiping decided to expand upstream , With 3500 Ten thousand yuan has purchased part of the mining right of the methylka mine in Ganzi Prefecture , But because of the high altitude 、 harsh , Delay in mining , All the main raw materials are still imported from talison .

at that time , China's dependence on foreign lithium raw materials is as high as 90%, Lithium ore imported every year ,80% All the shares are monopolized by talison , At that time, jiangweiping considered that China's lithium industry could not be controlled by others , It is planned to acquire lithium resources through the capital market , Promote the rapid leap forward development of the industry .

2010 year , After Tianqi lithium was listed , Jiangweiping has formulated for Tianqi lithium “ Become a global leader in new energy materials industry with lithium industry as the core ” The strategic goal of . after , Tianqi lithium is on the way of merger and acquisition “ Out of control ”:

2012 year , Tianqi lithium has obtained the mining right of Cuola spodumene mine in Yajiang County, Sichuan ;2014 year , Tianqi lithium acquired talison lithium 51% equity ; Same year 8 month , Tianqi lithium also acquired Zabuye lithium held by Tibet Mining 20% equity , Realize the layout of domestic high-quality salt lake lithium resources ;2015 year , Tianqi lithium also acquired the only fully automatic battery grade lithium carbonate production plant in operation in the world at that time —— Zhangjiagang production base in Jiangsu Province ;2018 year , Tianqi lithium has completed the investment in Chilean chemical mining company 23.77%A Acquisition of class equity , Become its second largest shareholder , Further optimize the company's layout of high-quality salt lake lithium resources .

And in a series of acquisitions , There are two crucial events “ The war ” It plays a key role in the success of Tianqi lithium industry :

1. The first time a snake swallowed an elephant “ The war ”

2012 year 8 month 23 Japan , One of talian's announcements made jiangweiping uneasy about sleeping and eating : Lockwood will pay the total price 7.29 US $billion acquisition of talison 100% Equity of .

Talison is the exclusive supplier of lithium concentrate of Tianqi lithium ,1996 From the year onwards , Tianqi lithium imports lithium concentrate from talison , At the peak, Tianqi lithium will buy talison 1/3 Lithium concentrate .

This means that if talison is acquired , Tianqi lithium will be more passive in ore supply . As a global lithium giant , Lockwood has many lithium mines in the world , To maximize the benefits , The possibility of Lockwood shutting down talison cannot be ruled out . Once that happens , For Tianqi lithium , No doubt it is strangled “ Throat ”, It is also a great threat to China's voice in lithium resources .

How to break the situation ? This is the problem that jiangweiping and Tianqi lithium are facing .

At the time ,2012 How strong is Tianqi lithium industry in ? assets 15 Billion , Market value 11 Billion , No annual revenue 4 Billion , Net profit is just 4000 Thousands of yuan , At that time, talison's total assets were about 20 Billion , Annual revenue is close to 8 Billion . As for the assets of the acquirer Lockwood, they are more recent 400 Billion , Annual revenue exceeds 150 Billion .

In order not to lose the voice of the lithium industry , Had to launch an acquisition . In terms of timing, it may not be the best opportunity , Strategically, you have to do it , It can be said that he was forced into Liangshan , Jiangweiping once said frankly .

For Jiang Weiping , The primary goal is to win a takeover battle first . So , Jiangweiping set up a subsidiary of Tianqi group in Hong Kong —— Windfield .

Wear the waistcoat of Sheffield , Jiangweiping began to snap up talison's shares .2012 year 9-11 month , Windfield transfers through secondary market transaction and OTC agreement respectively , Acquired talison 9.99%( The proportion of secondary market transactions reached 10% To be announced ) and 10%( The proportion of over-the-counter acquisitions reached 15% To be approved by the Australian foreign investment review board ) Equity of .

That's it , Windfield steals talison 19.99% Equity of , Become the second largest shareholder .

2012 year 11 month , The shareholders' meeting of talison was held , At the meeting , Windfield, who has considerable voting power, vetoed Lockwood's acquisition by one vote . The acquisition barrage was a resounding victory , next step , What jiangweiping should do is to complete the comprehensive acquisition of talison . According to the contract , Windfield needs to be in 2013 year 3 month 20 recently , One time payment 53.5 RMB .

Where does the money come from ? This is another problem that jiangweiping is facing , The previous barrage , Jiangweiping has done everything , I have borrowed everything I can .

It's just then , The state has done it .2013 year 2 month , CIC's strategic stake in windfield , holding 35%, ICBC also provided some loans . The money is in place , Jiangweiping immediately aimed at talison and left 80% equity , Launch takeover offer . Besides , The national competent authorities set up a green channel , Speed up all the procedures required to approve the acquisition ; The Australian Government , Relevant approvals are also progressing smoothly , Go through the whole process quickly .

Final , Through two price increases , Jiangweiping is higher than Lockwood 15% Quote for , Reach an acquisition agreement with talison , The acquisition was a complete success . Tianqi lithium also took a breathtaking leap , Become one of the industry leaders who can control the structure of lithium industry .

2. The second time the snake swallowed the elephant “ The war ”

2017 year 10 month 18 Japan ,SQM The first shareholder, potash Corporation of Canada, announced , Will be in 18 Divestiture of holdings within months SQM equity .

As an international lithium giant in Chile ,SQM High lithium concentration in hands 、 Large reserves 、 High quality salt lake with low mining cost —— Atacama Salt Lake . Get the right to exploit the salt lake , To a large extent, it has the pricing power of lithium .

SQM The essence of equity , It is the exploitation right and distribution right of lithium resources in Chile . The most powerful competitors for these shares are Tianqi lithium in China and Yabao in the United States ( Previously acquired Lockwood ). However, lithium is regarded as the core strategic resource by the Chilean government , The equity is finally sold to Tianqi ( China ) Or Yabao ( The United States ), It still needs the decision of the Chilean government .

Rely on multi pronged approach , Tianqi lithium successfully obtained the acquisition right .2018 year 5 month 28 Japan , Tianqi lithium released an announcement , Will be with 40.66 US $100 million acquisition SQM23.77% Equity of , Add the original 2.09% equity , Tianqi lithium got SQM25.86% equity , Become the second largest shareholder .

For Tianqi lithium , The second time the snake swallowed the elephant “ The war ”, Take down SQM, It means that Tianqi lithium has completely become one of the leaders of the global lithium industry , But it has also laid a foundation for Tianqi lithium “ hidden danger ”: In paying for the acquisition SQM Of my money ,7.26 US $billion will be provided by Tianqi lithium with its own funds , The rest 35 US $billion consists of bank loans and overseas raised funds . This led to the debt ratio of Tianqi lithium from the original 27.7%, Turn into 73.2%.

What does that mean? ? High debt ratio leads to high interest expense :35 The $billion M & a loan is in 2019 year 、2020 The interest expenses incurred in the first three quarters of the year were as high as 20.45 One hundred million yuan 、13.98 One hundred million yuan .

As early as 2018 year , Tianqi lithium plans to go public in Hong Kong , By listing in Hong Kong stocks , Raise funds to relieve the pressure of high debt .

But at that time, because he was burdened with billions of loans , In addition, the price of lithium carbonate, the main product of Tianqi lithium, fell sharply , There was a crisis in the capital chain of Tianqi lithium , Finally, it was suspended H Share issuance .

The case was heard by the Hong Kong stock exchange , No doubt 2018 The continuation of the road to listing in Hong Kong in . After the listing , Raised by Tianqi lithium 10-12 Billion dollars will also be used to repay SQM Outstanding balance of debt , And allocate funds for expansion projects .

Time comes and the world goes together , Heroes are not free .

One side , With the debt ratio of Tianqi lithium further reduced , In addition, it holds the largest and best mine and Salt Lake in the world , The future of Tianqi lithium is still limitless ; On the other hand , The new energy industry led by new energy vehicles has been accelerating its development process , The demand for lithium ore has increased significantly , For the upstream Tianqi lithium industry, it is also ushering in its own spring .

03

The era of hard technology is coming

More neck problems are being solved

The rise of Tianqi lithium industry , It reflects that a number of Chinese enterprises are trying to solve foreign monopolies 、 The problem of neck sticking .

Remove Tianqi lithium , There are also cases of Ganfeng lithium industry .1997 year , Liliangbin and four other people founded Ganfeng lithium metal factory , But Li Liangbin's first venture was not smooth , But full of frustrations . After raising money from various sources , Liliangbin and his team have just built a 10 Tons of metal lithium production line , And then , The management philosophy of the team is different 、 Internal corruption and other problems have led to the factory going bankrupt , Finally, liliangbin carried it alone 114 Ten thousand debts , Turn a business into a personal business .

Although Ganfeng lithium was on the right track again through restructuring , The development situation is getting better , But still not a giant . until 2010 year , Ganfeng lithium is listed on the Shenzhen Stock Exchange , With the blessing of the capital market , Ganfeng lithium has made a wave of acquisitions , Layout the upstream and downstream of lithium industry , Until the outbreak of the new energy industry .

2020 In, Ganfeng lithium achieved revenue 55.24 One hundred million yuan , The net profit attributable to the parent is 10.25 One hundred million yuan ,2021 year , The company achieves revenue 111.62 One hundred million yuan , The net profit attributable to the parent is 52.28 One hundred million yuan . Same year , Ganfeng lithium has directly or indirectly mastered 18 Lithium source , Total equity reserves reach 3000 Ten thousand tons of LCE( lithium carbonate equivalent ), Ranked first in the world .

in addition , Ningde era can also be regarded as a classic case of domestic substitution . Founded on 2011 year 12 month , Ningde times is relying on lithium battery technology in 2012 In, it reached a cooperation with BMW , Become the only battery supplier of BMW Group in the popular area .

thereafter , Ningde era is even more similar to SAIC 、 changan 、 BMW 、 Volkswagen, Weilai and other automobile enterprises at home and abroad have carried out cooperation ,2015 year 、2016 Years and 2017 year 3 year , The operating revenues of Ningde times are 57.03 One hundred million yuan 、148.79 Million dollars 199.97 One hundred million yuan ,2017 year , The sales volume of Ningde times power battery has become the first in the world .

2018 year 6 month 11 Japan , Ningde times was officially listed , On the day of listing, the market value reached 786.4 One hundred million yuan , After that, just 3 Year time , The market value of Ningde times has soared all the way ,2021 year 11 month 29 Japan , The highest price of the stock is 684.5 element , Hit a new high , The market value of Ningde era was once approaching 1.6 One trillion , With the soaring market value , The global power battery market once appeared “ Ning wang ” The situation of a single family .

More than that , Take the field of new energy power batteries as an example , In the past year, the super Unicorn beehive energy has obtained four huge sums of financing 、 Xinwangda automobile battery invested by Wei Xiaoli company in the Bureau 、 BYD, which has a market value of trillions 、 Zhongchuang Chuang hang and other enterprises are competing fiercely in the battery market , With many behind it VC/PE Institutions , There is another big play of heroes fighting for hegemony , The scene is vast , Very spectacular .

What is the result of the competition , We don't know , But one thing is clear : New energy , It is becoming a super track in China and even the world in the coming decades , Chinese enterprises have already occupied some first mover advantages .

in addition , We can see it, too , Previously, specialized and new enterprises hidden in various industries are gradually coming to the front , One after another previously unknown invisible champion enterprises are emerging . With the tide of the Internet receding , The next era belongs to hard technology 、 It belongs to the era of industry .

边栏推荐

- Technology creates value and teaches you how to collect wool

- Win the championship for 2 consecutive years! ZABBIX ranked first in a number of monitoring software in 2022

- 2021-04-15

- 大厂架构师:如何画一张大气的业务大图?

- Sqlserver2008r2 failed to install DTS component

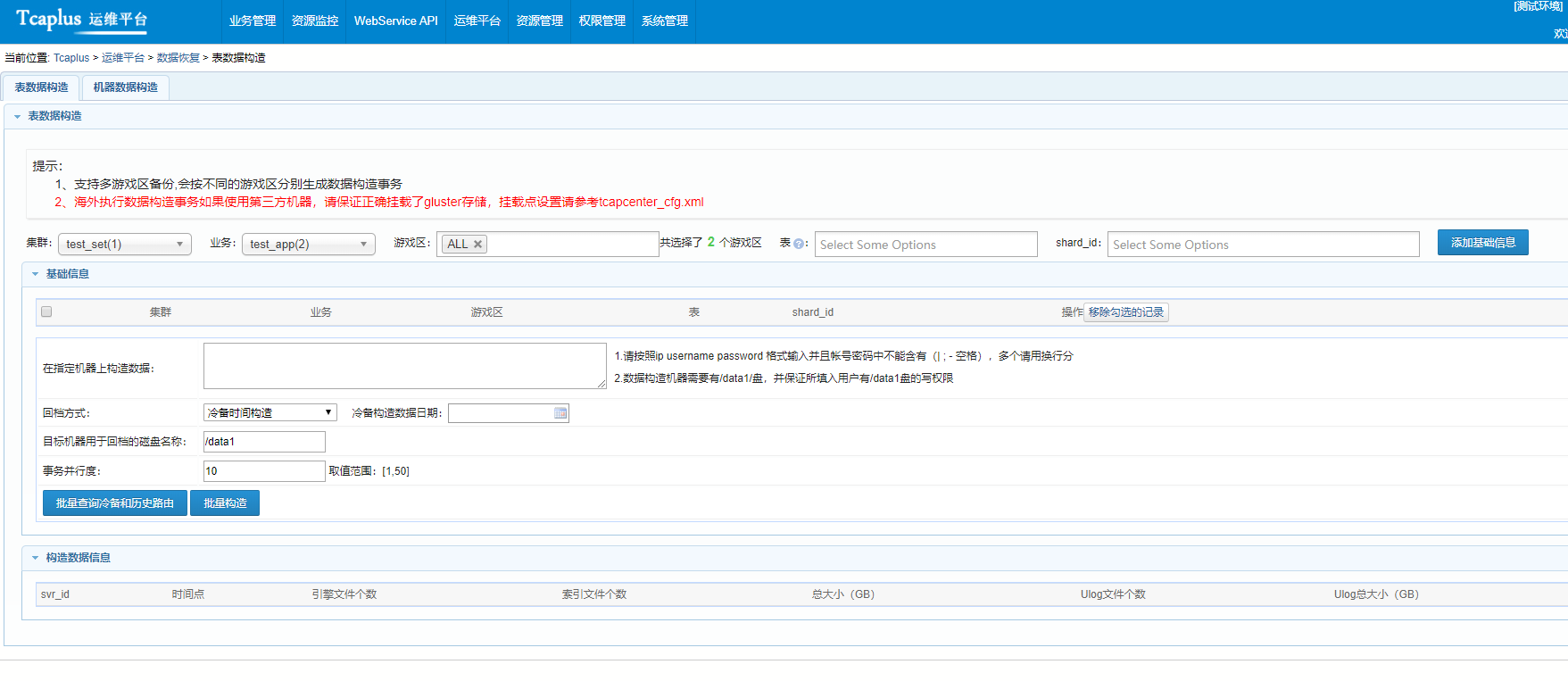

- [deeply understand tcapulusdb technology] table management of document acceptance

- Drop down menu scenario of wechat applet

- [digital signal processing] linear time invariant system LTI (judge whether a system is a "non time variant" system | case 2)

- Illustration of ONEFLOW's learning rate adjustment strategy

- Oracle进入sqlplus 报错

猜你喜欢

【深入理解TcaplusDB技术】TcaplusDB构造数据

![Web technology sharing | [Gaode map] to realize customized track playback](/img/b2/25677ca08d1fb83290dd825a242f06.png)

Web technology sharing | [Gaode map] to realize customized track playback

Analysis and solution of connection failure caused by MySQL using replicationconnection

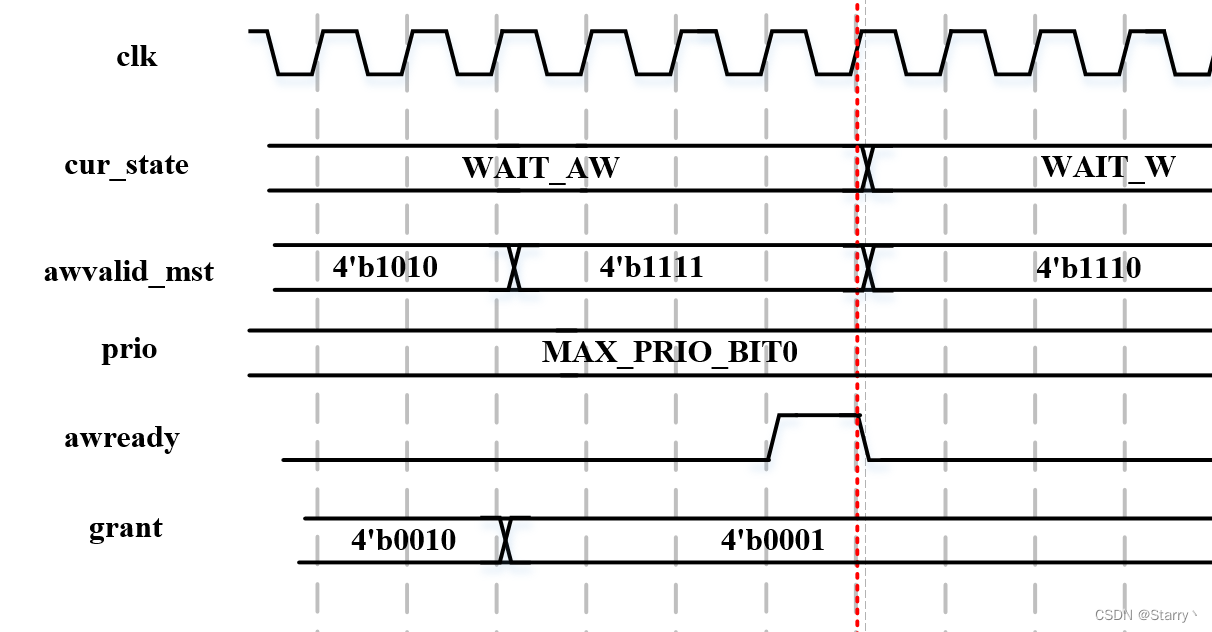

AXI_Round_Robin_Arbiter 设计 - AW、W通道部分

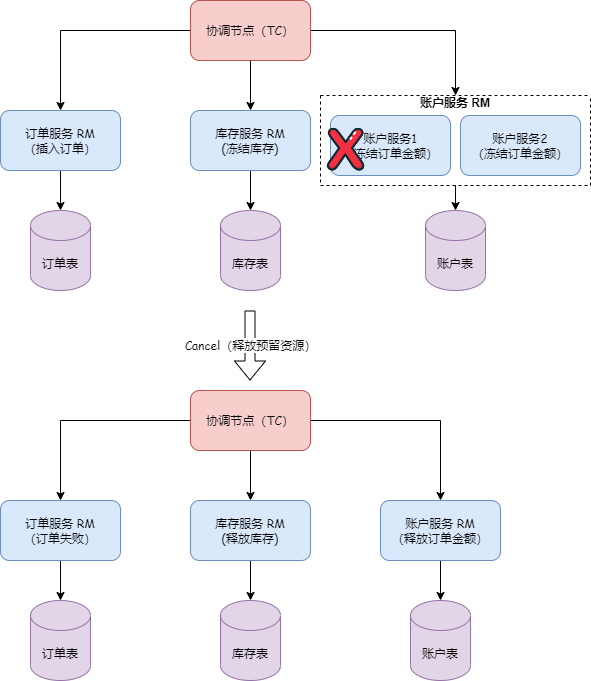

阿里 Seata 新版本终于解决了 TCC 模式的幂等、悬挂和空回滚问题

From the establishment to the actual combat of the robotframework framework, I won't just read this learning note

The first public available pytorch version alphafold2 is reproduced, and Columbia University is open source openfold, with more than 1000 stars

【深入理解TcaplusDB技术】TcaplusDB业务数据备份

Add Icon before input of wechat applet

![[deeply understand tcapulusdb technology] tcapulusdb import data](/img/c5/fe0c9333b46c25be15ed4ba42f7bf8.png)

[deeply understand tcapulusdb technology] tcapulusdb import data

随机推荐

[digital signal processing] linear time invariant system LTI (judge whether a system is a "non time variant" system | case 2)

[deeply understand tcapulusdb technology] one click installation of tmonitor background

What do you mean by waiting for insurance records? Where should I go for filing?

How to use note taking software flowus and note for interval repetition? Based on formula template

KDD'22「阿里」推荐系统中的通用序列表征学习

百万奖金等你来拿,首届中国元宇宙创新应用大赛联合创业黑马火热招募中!

Hot Recruitment! The second Tencent light · public welfare innovation challenge is waiting for you to participate

[deeply understand tcapulusdb technology] tmonitor system upgrade

Error when Oracle enters sqlplus

SAP inventory gain / loss movement type 701 & 702 vs 711 & 712

Test article

Soaring 2000+? The average salary of software testing in 2021 has come out, and I can't sit still

[in depth understanding of tcapulusdb technology] how to realize single machine installation of tmonitor

2021-04-15

Oracle进入sqlplus 报错

3 interview salary negotiation skills, easily win 2K higher than expected salary to apply for a job

vim备份历史命令

The first public available pytorch version alphafold2 is reproduced, and Columbia University is open source openfold, with more than 1000 stars

High quality coding - air quality map visualization

[in depth understanding of tcapulusdb technology] tcapulusdb construction data

Anonymous users

Anonymous users