当前位置:网站首页>量化投资学习——经典书籍介绍

量化投资学习——经典书籍介绍

2022-06-26 09:37:00 【量化橙同学】

1、《Quantitative Equity Portfolio Management》 作者:Ludwig B Chincarini/Daehwan Kim

2、《量化投资策略:如何实现超额收益Alpha》 作者:Richard Tortoriello

3、《Inside the Black Box:A Simple Guide to Quantitative and High Frequency》 作者:Rishi K Narang

4、《Algorithmic Trading and DMA:An introduction to direct access trading strategies》 作者:Barry Johnson

来自知乎大佬 董可人的回答:

因为我自己做高频,所以首先提两本相关的学术著作。一本是2011年的论文集 Econophysics of Order-driven Markets,收录了一系列关于盘口和高频数据建模的论文。另一本是2013年的 High-Frequency Trading book,包含一些策略研究和机器学习方面的应用。这两本一定程度上可以反应学界目前对这个领域的研究现状。接下来提几个重量级的学者,他们发表的相关论文都很有影响力,值得一读。Robert Almgren 在策略执行(execution),交易成本(trisection cost)以及Portfolio方面都有一系列著名的论文。Rama Cont 近几年有好几篇关于Order Book建模的非常不错的文章。Michael Kearns 本人是计算机系做机器学习的大牛,但是常年混迹于投资界(似乎参与某基金公司的策略研发),关于机器学习在交易方面的应用看他写的会比较有帮助。

大佬对于业界和学界的说法有一个精到的论述:

举一个例子,去年有人写了一篇 Critical reflexivity in financial markets: a Hawkes process analysis,用一种随机过程的模型来说明近年因为自动化交易的增加,导致市场中在微观尺度上出现一种连锁反应的现象(即一个交易事件可能会引发多个后续的交易事件)。模型做的很漂亮,数据分析也很充分,看起来很不错。但是紧跟着就有人写了一篇唱反调的 Apparent criticality and calibration issuesin the Hawkes self-excited point process model:

application to high-frequency financial data,详细的分析了交易数据源里可能存在的问题,比如说交易所在发出市场数据的时候可能会做一个打包处理,使得一个短时间内相邻几条交易的时间戳看起来是一样的,这样显然导致对时间的分析是有很大误差的。对这种细微的问题,如果没有一线生产的相关经验和深入理解,很容易带来研究方向上的误导。

Michael Kearns就对机器学习在这方面的应用有过精彩的论述(Machine Learning for Market Microstructure and High-Frequency Trading)

机器学习这一套的核心价值不是用来做什么预测和盈利策略(所谓的寻找alpha),而是优化

:Machine learning provides no easy paths to profitability or improved execution, but does provide a powerful and principled framework for trading optimization via historical data.We are not believers in the use of machine learning as a black box, nor the discovery of “surprising” strategies via its application. In each of the case studies, the result of learnings made broad economic and market sense in light of the trading problem considered. However, the numerical optimization of these qualitatitve strategies is where the real power lies.

边栏推荐

- Small example of SSM project, detailed tutorial of SSM integration

- How to change the QR code material color of wechat applet

- 2. merge two ordered arrays

- Control setting layout in linear layout_ Gravity doesn't work?

- Global and Chinese market of cryogenic bulk tanks 2022-2028: Research Report on technology, participants, trends, market size and share

- Procedure Call Standard

- Jar version conflict resolution

- Global and Chinese markets in hair conditioner 2022-2028: Research Report on technology, participants, trends, market size and share

- 字符串常量池、class常量池和运行时常量池

- Extracting public fragments from thymeleaf

猜你喜欢

瑞萨电子面向物联网应用推出完整的智能传感器解决方案

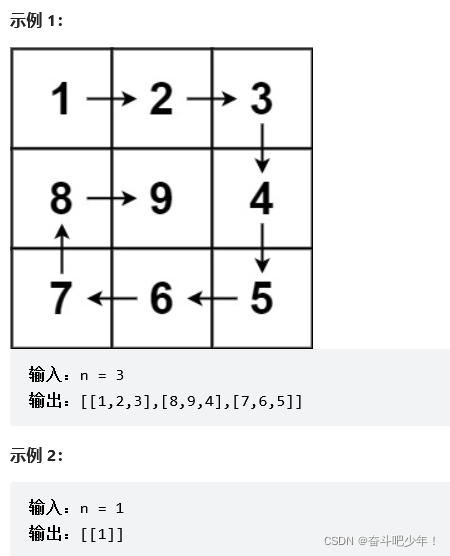

【LeetCode】59. Spiral matrix II

3行3列整形二维数组,求对角之和

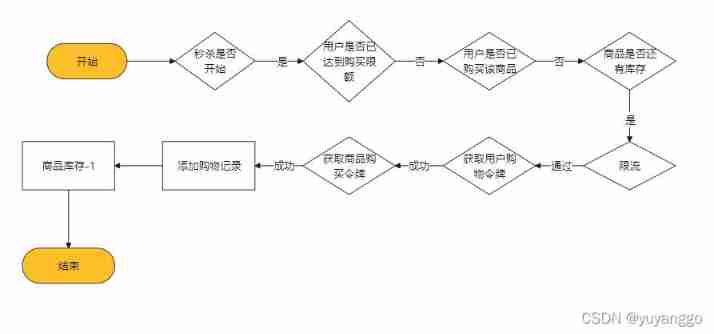

Little red book - Summary of internal sales spike project

C中字符串基本操作

How to change the QR code material color of wechat applet

Configuration internationale

How to start the learning journey of webrtc native cross platform development?

MySQL 11th job - view application

Omni channel, multi scenario and cross platform, how does app analyze channel traffic with data

随机推荐

MySQL 13th job - transaction management

Luogu 1146 coin flip

MySQL第六章总结

Threading model in webrtc native

Using foreach to loop two-dimensional array

How to change the QR code material color of wechat applet

MySQL第五章总结

【無標題】

什么是僵尸网络

libmagic 介绍

字符串常量池、class常量池和运行时常量池

P1296 whispers of cows (quick row + binary search)

Establishment of smart dialogue platform for wechat official account

Software testing - how to select the appropriate orthogonal table

Standard implementation of streaming layout: a guide to flexboxlayout

Detailed explanation of winsorflow quantum installation process

调用api接口生成不同颜色的微信小程序二维码

Searchview click failure

Flutter与原生通信(上)

Cmake / set command