当前位置:网站首页>Development trend and prospect forecast report of China's financial industry 2022-2028 Edition

Development trend and prospect forecast report of China's financial industry 2022-2028 Edition

2022-06-26 04:11:00 【Lh778855】

Development trend and prospect forecast report of China's financial industry 2022-2028 Edition of

For details, please consult Hongsheng Xinhe Research Institute !

【 New revision 】:2022 year 2 month

【 Author 】: Hongsheng Xinhe research

Body contents 2

Table of figures 9

The first 1 Chapter : Overview and situation of the development of China's financial industry 11

1.1 Analysis of the connotation of quasi financial industry 11

1.1.1 Definition and connotation of quasi financial industry 11

1.1.2 The main products and services of the financial industry 13

1.1.3 Characteristics of quasi financial industry 13

1.2 Analysis of international economic and financial situation 14

1.2.1 A brief analysis of the international financial market 14

1.2.2 Analysis of the development of global financial markets 14

1.2.3 Analysis on the development trend of global financial markets 15

1.2.4 The reform situation of international financial supervision 15

1.3 Development environment and strategic planning direction of China's financial industry 16

1.3.1 Analysis of China's financial strategic environment 16

(1) An analysis of the economic environment for the development of China's financial industry 16

(2) Opportunities and challenges for the development of China's financial industry 17

1.3.2 The actual supply of China's financial sector 22

1.3.3 Analysis on the strategic direction of China's financial sector 22

1.4 The framework of the four strategic objectives of China's financial sector 23

1.4.1 Marketization of domestic financial industry 23

1.4.2 Orderly financial opening to the outside world 23

1.4.3 A stable international financial environment 24

1.4.4 An effective regulatory system 24

1.5 Thoughts on the reform of China's financial industry 25

The first 2 Chapter : An analysis of the overall situation of China's financial markets 27

2.1 The operation of China's financial markets 27

2.2 The overall operation of such financial markets 27

2.3 Analysis on the operation of financial market segments 29

2.3.1 The operation of the microfinance market 29

2.3.2 The operation of the pawn market 29

2.3.3 Operation of financing guarantee market 29

2.3.4 Operation of financial leasing market 29

2.3.5 Operation of commercial factoring market 30

The first 3 Chapter : Analysis on the operation of major financial institutions in China 31

3.1 Analysis of the operation of small loans 31

3.1.1 Analysis of small loan income scale 31

(1) Asset size 31

(2) Income 32

3.1.2 Analysis of small loan profits 33

3.1.3 Risk analysis of small loan operation 33

3.1.4 Analysis of the ability to control the cost of small loans 35

3.1.5 The trend of small loan equity changes 35

3.2 Analysis of the operation of the pawn industry 35

3.2.1 Analysis on the income of pawn industry 37

(1) Number of pawnbroking institutions 37

(2) Income scale 38

3.2.2 Analysis of income composition of pawn industry 39

(1) The composition of income 39

(2) Traditional business income analysis 40

(3) Innovative business income analysis 41

3.2.3 Analysis on the profitability of pawn industry 42

3.2.4 Analysis on the operational risk of pawn industry 42

(1) Business operation risk analysis 42

(2) Profit risk analysis 43

(3) Suggestions on risk control of pawnbroking 44

3.2.5 The changing trend of the cost of the pawn industry 45

3.2.6 Analysis of chain operation in pawn industry 46

3.2.7 Problems in the pawn industry 49

3.2.8 An analysis of the development prospect of pawnbroking 57

3.2.9 Analysis on the development trend of pawn industry 59

3.2.10 Countermeasures for the development of pawn industry 61

3.3 Analysis of the operation of the financing guarantee industry 69

3.3.1 Analysis of premium income in financing guarantee industry 69

3.3.2 The financing guarantee industry is profitable 69

3.3.3 Cost analysis of financing guarantee industry 70

3.3.4 Breakdown of the financing guarantee industry 71

3.3.5 Analysis of operating expenses of financing guarantee companies 72

3.3.6 Analysis of operational risk of financing guarantee company 73

3.3.7 The cost change trend of financing guarantee companies 73

3.3.8 Development trend of financing guarantee industry 74

3.4 Analysis of the operation of the financial leasing industry 75

3.4.1 Analysis on income scale of financial leasing industry 75

3.4.2 Analysis of financial leasing funds 76

(1) Total financial lease assets 76

(2) Distribution of assets by source 77

(3) Investment orientation of financial leasing funds 77

3.4.3 Analysis on the profitability of the financial leasing industry 77

3.4.4 Analysis of operating risks in the financial leasing industry 77

3.4.5 The cost change trend of financial leasing industry 78

3.4.6 Development trend of financial leasing industry 79

3.5 Analysis of financial leasing operation 80

3.5.1 An overview of the financial leasing industry 80

(1) Number of enterprises 80

(2) Total business volume 81

3.5.2 Analysis on the scale of financial leasing companies 82

3.5.3 Analysis of financial leasing profitability 83

3.5.4 Analysis of financial leasing risk control capability 83

3.5.5 Change trend of finance lease cost 85

3.5.6 Development trend of financial leasing shares 87

3.6 Analysis of the operation of commercial factoring companies 87

3.6.1 Business performance analysis of commercial factoring companies 87

3.6.2 Asset analysis of commercial factoring companies 87

3.6.3 Business risk analysis of commercial factoring companies 88

3.6.4 Analysis on the development trend of commercial factoring companies 89

3.7 An analysis of the operation of the consumer finance industry 90

3.7.1 Consumer finance industry consumer finance balance analysis 90

3.7.2 Analysis of operational risk of consumer finance industry 91

3.7.3 Analysis on the development trend of consumer finance industry 91

3.8 Second hand luxury industry management analysis 92

3.8.1 The scale of companies and employees in the second-hand luxury industry 92

(1) Number of Companies 92

(2) Number of employees 93

3.8.2 Capital scale of second-hand luxury industry companies 94

3.8.3 Operating income of Companies in the second-hand luxury industry 95

3.8.4 Operating risks of second-hand luxury goods industry 96

3.8.5 The development trend of second-hand luxury industry companies 96

The first 4 Chapter : Analysis on the market innovation of Chinese financial products 98

4.1 Analysis of microfinance products 98

4.1.1 General information of microfinance products 98

4.1.2 Sales channels of microfinance products 98

4.1.3 Small loan product cooperation mode 99

4.1.4 Yield analysis of small loan products 100

4.1.5 Competition status of microfinance products 100

4.1.6 Innovation trend of microfinance products 101

4.2 Analysis of financing guarantee products 102

4.2.1 General information of financing guarantee products 102

4.2.2 Sales channels of financing guarantee products 103

4.2.3 Cooperation mode of financing guarantee products 104

4.2.4 Competition status of financing guarantee products 104

4.2.5 Innovation trend of financing guarantee products 104

4.3 Analysis of financial leasing products 108

4.3.1 General information of financial leasing products 108

4.3.2 Sales channels of financial leasing products 109

4.3.3 Cooperation mode of financial leasing products 109

4.3.4 Competition status of financial leasing products 111

4.3.5 Financial leasing product innovation trend 111

4.4 Pawn product analysis 112

4.4.1 Overall situation of pawn products 112

4.4.2 Pawn product sales channels 113

4.4.3 Pawn product cooperation mode 113

4.4.4 Analysis of financial products of pawn classification 114

4.4.5 The current situation of pawn product competition 114

4.4.6 The innovation trend of pawn products 115

The first 5 Chapter : Global microfinance development 117

5.1 A summary of global international microfinance development 117

5.2 The development status of global international microfinance 117

5.3 Analysis on the development pattern of global international microfinance 118

5.4 Analysis on the development trend of global international microfinance 119

5.5 Analysis on the development of microfinance in the UK 120

5.6 An analysis of the development of microfinance in the United States 121

5.7 An analysis of the development of microcredit in Germany 122

5.8 An analysis of the development of microfinance in Japan 123

The first 6 Chapter : Analysis on the comprehensive operation pattern of Chinese financial enterprises 125

6.1 Comprehensive business model of domestic and foreign financial enterprises 125

6.2 Comprehensive operation of financial industry SWOT analysis 132

6.2.1 Analysis of the advantages of the financial industry 132

6.2.2 An analysis of the disadvantages of the financial industry 132

6.2.3 Analysis on the comprehensive operation and development opportunities of the financial industry 132

6.2.4 Comprehensive operation risk analysis of financial industry 133

6.3 Analysis of M & A integration of financial enterprises 133

6.3.1 Analysis on the current situation of M & A between similar financial institutions 133

6.3.2 M & A integration trend in the financial industry 134

6.4 Analysis on the business combination of financial industry segments 134

6.4.1 Correlation analysis of return on assets of sub industries 134

6.4.2 Correlation analysis between business segments 135

(1) Comparison of sub industries and business areas 135

(2) Asset management business comparison 136

(3) The rate of return of financial products is relatively 137

6.4.3 Analysis on the benefit of the sub industry combination of finance 137

6.4.4 Suggestions on comprehensive operation of financial sub industries 138

(1) Comprehensive business model selection 138

(2) Selection principle of comprehensive business model 139

The first 7 Chapter : China's financial industry trends and enterprise strategic planning 141

7.1 Analysis on the development trend of China's financial industry 141

7.1.1 Analysis of the development trend of the financial industry 141

7.1.2 Analysis of the development trend of the financial segment market 142

(1) banking 142

(2) Pawn business 143

(3) Financing guarantee industry 143

(4) Financial leasing industry 144

7.1.3 Analysis on the competitive trend of the financial industry 144

(1) The level of future competition in the financial industry 144

(2) Potential entrants to non-financial institutions 145

7.1.4 The changing trend of financing channels of financial enterprises 145

(1) Diversified financing channels 145

(2) Diversified financing methods 145

(3) Structured financing products 146

7.1.5 Early warning of financial crisis risks in China 146

7.2 Analysis on the development planning of regional financial industry 146

7.2.1 Analysis of national financial comprehensive reform pilot area 146

7.2.2 Analysis on the operation of regional finance in China 147

7.2.3 Analysis on the development trend of regional financial industry 148

(1) The East 148

(2) The central region 149

(3) Western Region 150

(4) The northeast 151

7.3 Analysis of the development opportunities of the financial industry 152

7.3.1 Market oriented development opportunities for the financial industry 152

7.3.2 International development opportunities for the financial industry 153

7.3.3 Information development opportunities for the financial industry 153

(1) The amount of investment in this kind of financial informatization is growing 153

(2) The scale of the quasi fintech market continues to expand 153

7.4 Suggestions on the ways to make profits of financial institutions of the same kind 154

7.4.1 Suggestions on the ways to make small loans profitable 154

(1) The current situation of the bank's profit model 154

(2) The development trend of small loans 155

7.4.2 Suggestions on how to make profits in the pawn industry 155

(1) The current situation of the profit-making channels of the pawn industry 155

(2) The trend of innovative profit model of pawn management organizations 156

(3) Pawn companies' profit model innovation 157

7.4.3 Suggestions on ways to make profits in the financing guarantee industry 157

7.4.4 Suggestions on the profit path of financial leasing industry 158

(1) Actively seek market positioning 158

(2) Highlight the brand and its own institutional advantages 159

(3) Exploration of other financial leasing businesses 159

7.4.5 Suggestions on the ways to make profits from financial leasing 160

(1) Financial leasing profit model 160

(2) The way to improve the profitability of financial leasing companies 161

7.4.6 Suggestions on how to make profits for commercial factoring companies 164

appendix : Analysis on the market development of Liaoning financial industry 166

1、 Development of Liaoning financial industry 166

2、 Liaoning small loan asset scale 166

3、 Analysis on the advantages and disadvantages of Liaoning financial industry 167

4、 Analysis of leading enterprises in Liaoning financial industry 168

4.1 Liaoning Yidong pawn Co., Ltd 168

4.1.1 Basic overview of the enterprise 168

4.1.2 The main business of the enterprise 168

4.1.3 Analysis of enterprise operation 169

4.1.4 Enterprise advantage analysis 169

Table of figures

Chart :2016-2021 The asset scale of China's microfinance industry in 31

Chart :2016-2021 Sales revenue of China's microfinance industry in 32

Chart :2016-2021 The number of pawnbroking institutions in China in 38

Chart :2016-2021 Sales revenue of China's pawn industry in 39

Chart :2016-2021 The traditional business income of China's pawn industry in 40

Chart :2016-2021 The innovative business income of China's pawn industry in 41

Chart :2016-2021 The cost of China's pawn industry in 45

Chart :2016-2021 Profit of China's financing guarantee industry in 69

Chart :2016-2021 The cost of China's financing guarantee industry in 70

Chart :2016-2021 Operating expenses of China's financing guarantee industry in 72

Chart :2021-2027 Cost forecast of China's financing guarantee companies in 73

Chart :2016-2021 Sales revenue of China's financial leasing industry in 75

Chart :2016-2021 The asset scale of China's financial leasing industry in 76

Chart :2021-2027 Cost forecast of China's financial leasing industry in 78

Chart :2021-2027 Forecast of asset scale of China's financial leasing industry in 79

Chart :2016-2021 Number of financial leasing institutions in China in 80

Chart :2016-2021 The total business volume of China's financial leasing industry in 81

Chart :2016-2021 The asset scale of China's financial leasing industry in 82

Chart :2016-2021 The profitability of China's financial leasing industry in 83

Chart :2016-2021 The asset scale of Chinese commercial factoring companies in 87

Chart :2021-2027 Forecast of the market size of Chinese commercial factoring companies in 89

Chart :2016-2021 The balance of consumer finance in China's consumer finance industry in 90

Chart :2016-2021 The number of Companies in China's second-hand luxury industry in 92

Chart :2016-2021 The number of employees in China's second-hand luxury industry in 93

Chart :2016-2021 The capital scale of China's second-hand luxury industry companies in 94

Chart :2016-2021 The operating income of China's second-hand luxury industry companies in 95

Chart :2016-2021 year 11 In June, the scale of global international microfinance assets 117

Chart :2021-2027 The scale of global international microfinance assets in 119

Chart :2016-2021 year 11 In June, the scale of UK microfinance assets 120

Chart :2016-2021 year 11 U.S. microfinance asset size in June 121

Chart :2016-2021 year 11 In June, the asset scale of German micro loans 122

Chart :2016-2021 year 11 In June, the scale of Japanese microfinance assets 123

Chart :2016-2021 The asset scale of China's microfinance industry in 147

Chart :2016-2021 year 11 In June, the scale of small loan assets in eastern China 148

Chart :2016-2021 year 11 In June, the asset scale of small loans in Central China 149

Chart :2016-2021 year 11 In June, the asset scale of small loans in Western China 150

Chart :2016-2021 year 11 In June, the scale of small loan assets in Northeast China 151

Chart :2016-2021 year 11 In June, the asset scale of Liaoning microfinance 166

Chart : Business status of Liaoning Yidong pawn Co., Ltd 169

边栏推荐

- Concept and implementation of QPS

- Wechat applet is bound to a dynamic array to implement a custom radio box (after clicking the button, disable the button and enable other buttons)

- MySQL common statements

- Redis cache data consistency solution analysis

- BSC 及HT 等链的NFT 创造及绑定图片教程

- College C language final exam · multiple choice questions · summary notes of mistakes and difficulties

- Nailing open platform - applet development practice (nailing applet client)

- 816. fuzzy coordinates

- Introduction Guide to the flutterplugin plug-in in the actual combat of flutter

- Chrome page recording and playback function

猜你喜欢

The style of the mall can also change a lot. DIY can learn about it

Matplotlib line chart, text display, win10

Use soapUI to access the corresponding ESB project

(15) Blender source code analysis flash window display menu function

捕获数据包(Wireshark)

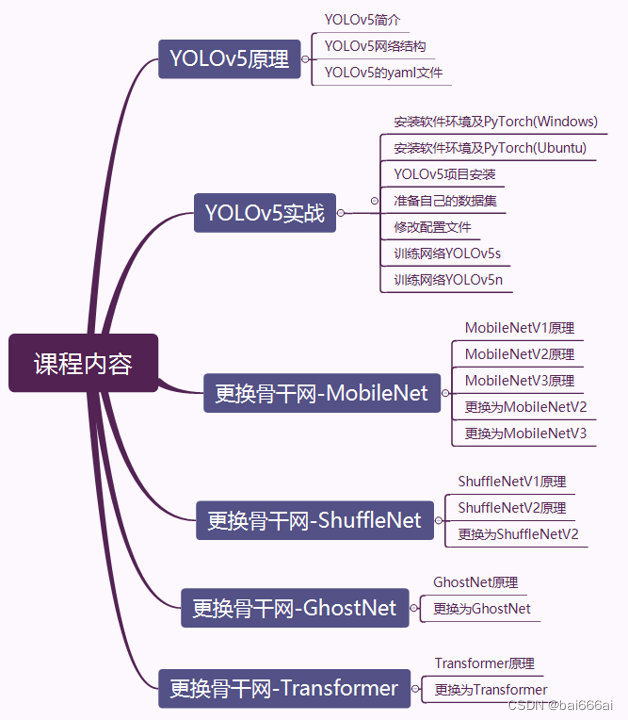

YOLOv5改进:更换骨干网(Backbone)

matplotlib多条折线图,点散图

Dix critères de base importants pour les essais de débogage de logiciels

Chrome page recording and playback function

What should I do if the 51 SCM board cannot find the device in keil

随机推荐

[collection of good books] from technology to products

Quanergy welcomes Lori sundberg as chief human resources officer

Getter actual combat geTx tool class encapsulation -getutils

神经网络学习小记录71——Tensorflow2 使用Google Colab进行深度学习

刷题记录Day01

[QT] dialog box

What should I do if the 51 SCM board cannot find the device in keil

NFT creation and binding of BSC and HT chains

Binary search method

Redis cache data consistency solution analysis

Double buffer technology asynchronous log system

What preparation should I make before learning SCM?

Knowledge of SQL - database design, backup and restore

外包干了四年,人直接废了。。。

线程同步之条件变量

Conditional variables for thread synchronization

2021 year end summary

Swagger

[Nuggets' operation routine disclosure] the routine of being truly Nuggets

Judge the same value of two sets 𞓜 different values