当前位置:网站首页>U.S. House of Representatives: digital dollar will support the U.S. dollar as the global reserve currency

U.S. House of Representatives: digital dollar will support the U.S. dollar as the global reserve currency

2022-06-24 23:51:00 【Gyro Finance】

source /cointelegraph

compile /Nick

With more and more attention paid to the digitalization of the US dollar , A congressman put forward his vision .

U.S. congressman Jim Himes (D-CT) A copy called “ Win the future of money : US central bank digital currency proposal ” White paper for . It includes global CBDC Summary adopted , And right CBDC Traditional assessment of advantages and disadvantages . The white paper supports Congress' authorization of the Federal Reserve to issue CBDC Action .

“ It is now time for Congress to consider and finally pass enabling legislation to issue the United States CBDC It's time ,” a member of the House of Representatives Jim Himes say .

Connecticut congressman Jim Himes Issued a proposal , The purpose is to start a dialogue on the possible introduction of central bank digital currency in the United States .

In a white paper released on Wednesday ,Jim Himes Urge Congress to start exploring the introduction of digital dollars issued by the Federal Reserve , To prevent the government from falling behind in financial technology innovation . The digital dollar will support the role of the US dollar as a global reserve currency , It can support individuals with insufficient bank accounts , And may be more creditworthy than a stable currency issued by a private company . According to American lawmakers ,CBDC It should not be considered as a substitute for traditional payment systems and currencies , But as an additional choice for consumers and enterprises .

The white paper makes a proposal , Compared with legal tender ,CBDC It may arouse people's concern about transparency 、 Security and privacy concerns .Himes Add , Any Act enacted by Congress CBDC Regulatory frameworks should include “ Powerful user identification process , An intermediary is required to prove the identity of the wallet holder ”, And by the Federal Reserve and “ Participating business entities ” Develop guidance .

“ The longer the U.S. government waits to accept this innovation , The more we fall behind foreign governments and the private sector ,” Jim Himes say .“ It is now up to Congress to consider and advance the mandate of the United States CBDC It's time to legislate .”

Different agencies and departments within the U.S. government have explored the possible impact of digital dollars when officials decide to launch digital dollars .5 month , The Federal Reserve released a report , The conclusion is that “ retail CBDC The implementation of monetary policy is highly dependent on the initial conditions of the Federal Reserve's balance sheet .”

Among American lawmakers ,Jim Himes Often push Congress to take action against cryptocurrencies —— In particular, the technology used to examine Russia's potential to evade sanctions —— And put forward part of a bill , Many have criticized the bill for giving the Treasury Secretary unrestricted power over certain cryptocurrency transactions .

The representative of Minnesota Tom Emmer Also in the 1 A bill was introduced in January , It aims to prevent the Federal Reserve from acting as a retail bank when it may issue digital dollars , This shows that the legislators have not yet made a decision on the United States CBDC Reach a consensus .

Recommended reading :

The encryption market has plummeted ,stETH Cause a new round of concern

Change of name All in The field of encryption ,Dorsey to Block How to choose the way ?

Web3 In China, , The elephant in the room

Before the United States CFTC chairman : Encrypted lending platforms should be strictly regulated

NFTs、Web3 And what does metauniverse mean to digital marketing ?

边栏推荐

- throttle-debounce.js:一个小型的防抖节流函数库

- go 语言指针,值引用和指针引用

- 抖音實戰~項目關聯UniCloud

- Quickly build KVM virtual machine on # yyds dry goods inventory # physical machine

- JPA学习2 - 核心注解、注解进行增删改查、List查询结果返回类型、一对多、多对一、多对多

- Using ADC to control brushless motor source program STM32 library function

- Andersen global strengthens the Middle East platform with Palestinian member companies

- 同济、阿里获CVPR最佳学生论文,李飞飞获黄煦涛奖,近6000人线下参会

- openGauss内核:简单查询的执行

- Using external Libpcap library on ARM platform

猜你喜欢

STM32CubeIDE SWV功能使用方法

7-6 laying oil well pipeline

使用网络摄像头进行眼睛注视估计

颜色渐变梯度颜色集合

How to use stm32subeide SWV function

Solution of IP network broadcasting system in Middle School Campus - Design Guide for Campus Digital IP broadcasting system

7-7 digital triangle

Hydropower project construction scheme based on 3D GIS Development

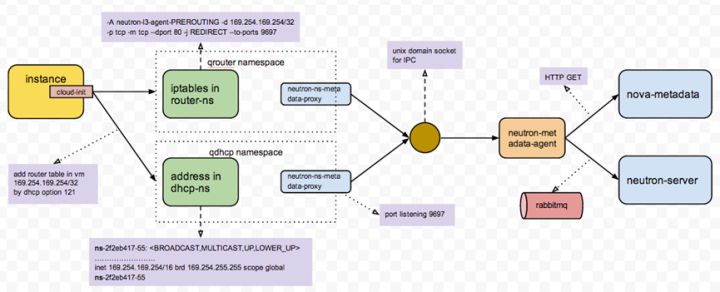

一文理解OpenStack网络

js监听页面或元素scroll事件,滚动到底部或顶部

随机推荐

为什么越来越多的实体商铺用VR全景?优势有哪些?

有趣的checkbox计数器

今天睡眠质量记录79分

Adding, deleting, querying and modifying MySQL tables

Annual salary of millions, 7 years of testing experience: stay at a fairly good track, accumulate slowly, wait for the wind to come

Tremblement de terre réel ~ projet associé unicloud

Installing IBM CPLEX academic edition | CONDA installing CPLEX

Why do more and more physical stores use VR panorama? What are the advantages?

JS listens for page or element scroll events, scrolling to the bottom or top

Using ADC to control brushless motor source program STM32 library function

创意SVG环形时钟js特效

MySQL problem points

Record a Webflux application memory leak troubleshooting

Understanding openstack network

一文理解OpenStack网络

7-7 digital triangle

∞ symbol line animation canvasjs special effect

Uninstall hero League

The living standards of ordinary people

Is there really something wrong with my behavior?