当前位置:网站首页>Quantitative investment learning - Introduction to classic books

Quantitative investment learning - Introduction to classic books

2022-06-26 10:26:00 【Quantitative orange】

1、《Quantitative Equity Portfolio Management》 author :Ludwig B Chincarini/Daehwan Kim

2、《 Quantitative investment strategy : How to achieve excess returns Alpha》 author :Richard Tortoriello

3、《Inside the Black Box:A Simple Guide to Quantitative and High Frequency》 author :Rishi K Narang

4、《Algorithmic Trading and DMA:An introduction to direct access trading strategies》 author :Barry Johnson

From Zhihu boss Dong Keren's answer :

Because I do high frequency , So first of all, I will mention two related academic works . A book is 2011 A collection of papers Econophysics of Order-driven Markets, A series of papers on disk port and high-frequency data modeling are included . The other is 2013 Year of High-Frequency Trading book, It includes some application of strategy research and machine learning . To a certain extent, these two books can reflect the current research status of this field in the academic circles . Next, I will mention some heavyweight scholars , Their relevant papers are very influential , Worth reading .Robert Almgren During policy execution (execution), Transaction costs (trisection cost) as well as Portfolio There are a series of famous papers on .Rama Cont In recent years, there have been several articles on Order Book Modeling of a very good article .Michael Kearns I am a computer major in machine learning , But he has been in the investment world for many years ( Seems to participate in the strategic research and development of a fund company ), Regarding the application of machine learning in trading, it would be helpful to see what he wrote .

The boss has a profound discussion on the views of the industry and academia :

For example , Someone wrote an article last year Critical reflexivity in financial markets: a Hawkes process analysis, A stochastic process model is used to explain the increase of automated trading in recent years , It leads to a chain reaction phenomenon on the micro scale in the market ( That is, one transaction event may trigger multiple subsequent transaction events ). The model is beautifully made , The data analysis is also sufficient , It looks good . But immediately after that, someone wrote an article that was repugnant Apparent criticality and calibration issuesin the Hawkes self-excited point process model:

application to high-frequency financial data, The possible problems in the transaction data source are analyzed in detail , For example, when the exchange sends out market data, it may do a package processing , Make the timestamp of several adjacent transactions look the same in a short time , This obviously leads to a great error in the analysis of time . For such a subtle problem , If there is no relevant experience and in-depth understanding of front-line production , It is easy to mislead the research direction .

Michael Kearns I have had a wonderful discussion on the application of machine learning in this field (Machine Learning for Market Microstructure and High-Frequency Trading)

The core value of machine learning is not to make predictions or profit strategies ( The so-called search alpha), It's about optimization

:Machine learning provides no easy paths to profitability or improved execution, but does provide a powerful and principled framework for trading optimization via historical data.We are not believers in the use of machine learning as a black box, nor the discovery of “surprising” strategies via its application. In each of the case studies, the result of learnings made broad economic and market sense in light of the trading problem considered. However, the numerical optimization of these qualitatitve strategies is where the real power lies.

Reference material : What are the ten most important reference books in the field of quantitative trading in the past decade ?

边栏推荐

- Jar version conflict resolution

- MySQL learning summary

- Introduction to libmagic

- 【Leetcode】76. Minimum covering substring

- How do technicians send notifications?

- MySQL第五章总结

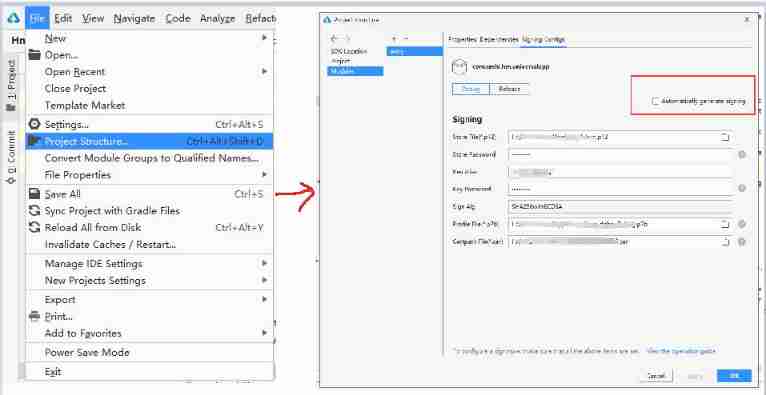

- Appium自动化测试基础 — 移动端测试环境搭建(二)

- Glide's most common instructions

- 【二分查找】4. 寻找两个正序数组的中位数

- Problems encountered in the application and development of Hongmeng and some roast

猜你喜欢

開發者,微服務架構到底是什麼?

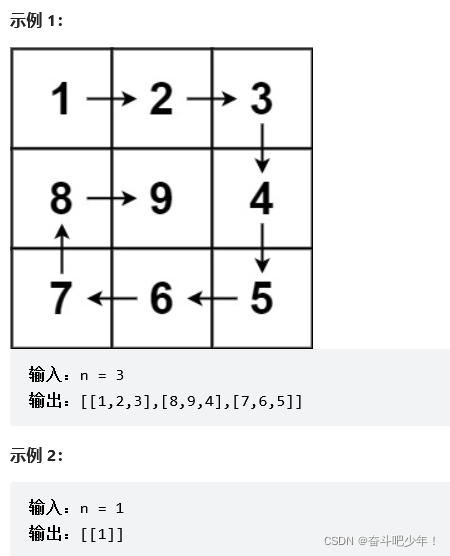

【LeetCode】59. Spiral matrix II

The IE mode tab of Microsoft edge browser is stuck, which has been fixed by rolling back the update

Differences between JVM, Dalvik and art

Reshape a two-dimensional array with 3 rows and 3 columns to find the sum of the diagonals

Small example of SSM project, detailed tutorial of SSM integration

Problems encountered in the application and development of Hongmeng and some roast

DBSCAN

The fourteenth MySQL operation - e-mall project

Software testing - how to select the appropriate orthogonal table

随机推荐

Little red book - Summary of internal sales spike project

Allocation de mémoire tas lors de la création d'objets

Express (I) - easy to get started

[sans titre]

Today's headline adaptation scheme code

Allocation of heap memory when creating objects

利用foreach循环二维数组

MySQL第十二次作业-存储过程的应用

Download MySQL database installation package website of each system and version

二叉树常见面试题

2. merge two ordered arrays

In the fragment, the input method is hidden after clicking the confirm cancel button in the alertdialog (this is valid after looking for it on the Internet for a long time)

MySQL project 8 summary

Use of exec series functions (EXECL, execlp, execle, execv, execvp)

MySQL第五章总结

1. 两数之和(LeetCode题目)

Little red book - Notes inspiration - project summary

【無標題】

String类intern()方法和字符串常量池

Yarn package management tool