当前位置:网站首页>Chicken and egg, products and Strategies

Chicken and egg, products and Strategies

2022-07-23 14:15:00 【Tomato risk control】

Today, I'd like to discuss the problem of chicken and egg in this industry .

Maybe you in the risk control industry have been thinking about this philosophical problem that I have thought about countless times .

The chicken and egg here are controlled by the wind , I mean products and strategies . This is often on the table , The most discussed with several peers is the strategic decision-making and financial products in risk control, which is more important ? There is a view that strategic decisions serve financial products , Therefore, financial products should be placed in a more important position . The bottom of financial products cannot be separated from quotas and rates , The quota and rate have selected the target customer group , So “ First of all ‘ chicken ’ Incubate the complex egg of strategic decision ”. However, another view is that if there is no financial product under strategic decision-making, it is only a ‘ chicken ’ Hatched a hollow egg . therefore , Dear friends , Do you have your opinion ?

As a person who has been engaged in risk control in the field of credit for nearly a decade, look back , I have made too many kinds of credit products and have deep experience , Financial products are very strict for the division of target customer groups , The impact of risk control strategy behind it is also huge .

There are many kinds of financial products of credit , No matter which type, there is a differentiated risk control strategy decision combined with it , After financial products have targeted the target customer group , It is necessary to formulate the matching quota and rate .

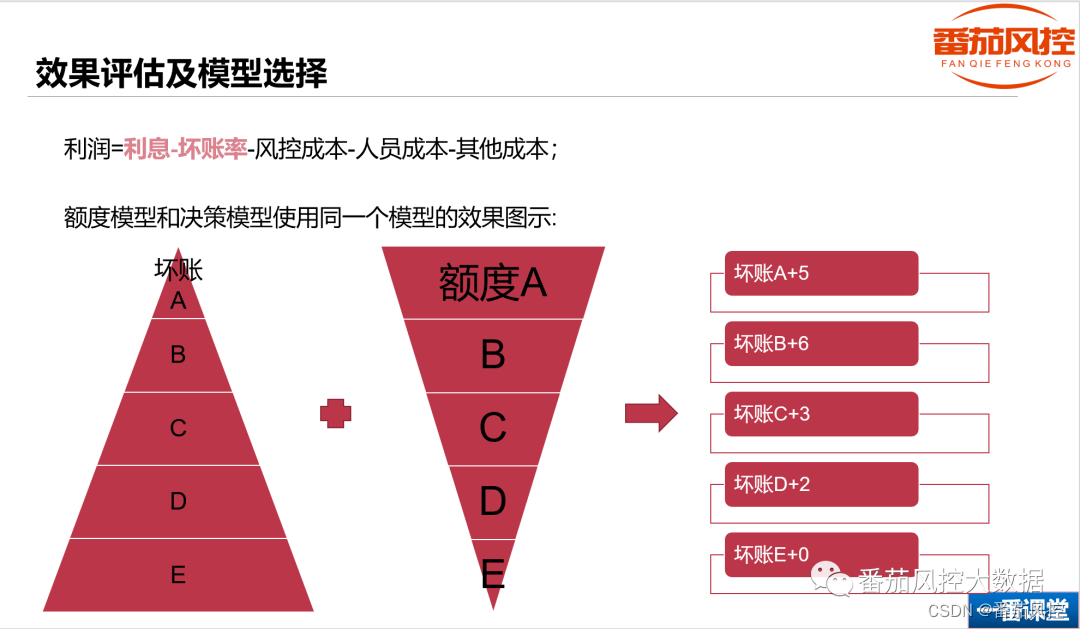

With the guidance of regulatory policy, the rate limits , It means that there is little space for the risk controller to operate . But the quota has been moving forward with the risk control strategy , The change of quota is often accompanied by the change of risk , The amount more matching with the target customer group is very important for the later repayment , If the amount exceeds the customer's repayment ability, it faces the problem of having the willingness to repay but not the ability to repay , The amount is lower than the customer's repayment ability, even if the customer has no willingness to repay, which is also very helpful for timely collection or collection . But not all customer groups have the minimum credit line , Although the risk has been reduced , But the profitability of financial products has been greatly reduced . After all, for a mature enterprise, the overall operating profit is considered , It's not just bad debt rate , For quota and profitability ( Bad debt ratio ) How to balance has become another difficulty in the overall planning of risk control strategy .

above , It's personal thinking about strategies and products . If you also know how to optimize the quota , If you are interested in how to expand the profit rules , You may wish to participate in the learning of this weekend's quota strategy tuning topic , In the course, we will share how to develop the hierarchical means of screening quota 、 How to optimize the credit line , Achieve the maximum profit of the company on the basis of risk control . Looking forward to your coming

The course covers content and cases :

1、 How to increase credit line from profit ;

2、 Advantages and disadvantages of sharing strategic decision model and quota model ;

3、 How to plan a large-scale plan with multiple models ;

4、 How to plan the reduction plan with multiple models ;

Display of some courseware :

More highlights , Interested children's shoes can pay attention to :

…

~ Original article

边栏推荐

猜你喜欢

Differences between Xiaomi 12s pro and Xiaomi 12pro Tianji version configuration comparison between the two

ThreadLocal 面试夺命11连问

Principle of container network

Tensor、Numpy、PIL格式转换以及图像显示

Configure the firetracker process, i.e. stepping on the pit record

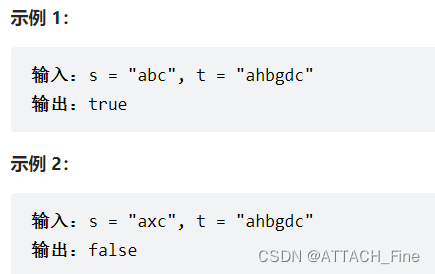

子序列 --- 编辑距离

太平洋大西洋水流问题

iQOO 10 Pro和vivo X80 Pro区别 哪个好详细参数配置对比

天玑1100相当于骁龙多少处理器 天玑1100相当于骁龙多少 天玑1100怎么样

Medium range

随机推荐

fastadmin更改默认表格按钮的弹窗大小

Notes on the fourth day

OSPF details (1)

接口interface

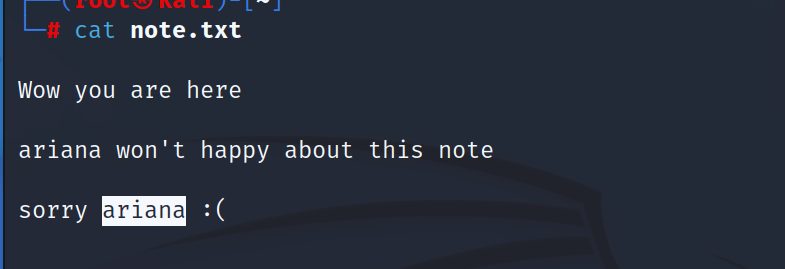

shell跑的時候需要的需要了解命令

581. 最短无序连续子数组

强化學習——策略梯度理解點

达人评测 酷睿i9 12950hx和i9 12900hx区别哪个强

天玑1100相当于骁龙多少处理器 天玑1100相当于骁龙多少 天玑1100怎么样

Pbootcms数据库转换教程(sqlite转mysql详细教程)

Comparison of iqoo 10 pro and Xiaomi 12 ultra configurations

How about the nuclear display performance of Ruilong R7 Pro 6850h? What level is it equivalent to

BGP federal experiment

Static comprehensive experiment (HCIA)

完全背包!

How many processors is Tianji 820 equivalent to Xiaolong? How about Tianji 1100 equivalent to Xiaolong? How about Tianji 820

Uiscrollview (uicollectionview) prohibits horizontal and vertical sliding at the same time

104 二叉树的最大深度 和 543 二叉树的直径和 124 二叉树的最大路径和

rtx3070ti显卡什么水平 rtx3070ti显卡什么级别 rtx3070ti显卡怎么样

第十一天笔记