当前位置:网站首页>Yilian technology rushes to Shenzhen Stock Exchange: annual revenue of RMB 1.4 billion, 65% of which comes from Ningde times

Yilian technology rushes to Shenzhen Stock Exchange: annual revenue of RMB 1.4 billion, 65% of which comes from Ningde times

2022-06-22 15:21:00 【leijianping_ ce】

RedI network Lei Jianping 6 month 21 Reported Wednesday

Shenzhen Yilian Technology Co., Ltd ( abbreviation :“ Yilian Technology ”) The prospectus was submitted a few days ago , Prepare to be listed on the growth enterprise market of Shenzhen Stock Exchange . Yilian technology plan fundraising 11.93 One hundred million yuan .

among ,5.48 Billion yuan is used for the production of series products of electrical connection components in Liyang construction project ,1.42 Billion yuan is used for the production and construction project of Ningde electric connection component series products ,1.39 Billion yuan is used for the production and construction project of new energy electrical connection components series products ,6426 Ten thousand yuan is used for R & D center construction project ,3 Billion yuan is used to supplement working capital .

Annual revenue 14 Billion 65% Income comes from Ningde era

Onelink technology is a research and development company of collector connection components 、 Design 、 production 、 sales 、 A service provider of products and solutions .

Yilian technology has been established in Shenzhen, Guangdong 、 Fujian ningde 、 Liyang, Jiangsu Province 、 Production bases have been established in Yibin, Sichuan and Yueqing, Zhejiang , The main products cover cell connection components 、 Power transmission components, low-voltage signal transmission components and other electrical connection components , It has formed a new energy vehicle as the development axis , Energy storage system 、 Industrial equipment 、 Medical equipment 、 The industrial development pattern of consumer electronics and other application fields .

The prospectus shows , Yilian Technology 2019 year 、2020 year 、2021 The annual revenue is 7.35 One hundred million yuan 、7 One hundred million yuan 、14.34 One hundred million yuan ; The net profit is respectively 8191.8 Ten thousand yuan 、6518 Ten thousand yuan 、1.43 One hundred million yuan ; The net profit after deducting non profits is 5290 Ten thousand yuan 、5361 Ten thousand yuan 、1.39 One hundred million yuan .

During the reporting period , The operating revenues of the company from the top five customers are 5.41 One hundred million yuan 、5.25 Million dollars 11 One hundred million yuan , The proportion of business income is 73.6%、75.11% and 77.12%, Among them, the proportion of operating income from Ningde era is 59.71%、62.38% and 64.72%.

At the end of each reporting period , The book value of the company's accounts receivable is 2.2 One hundred million yuan 、2.52 Million dollars 4.97 One hundred million yuan , The proportion of current assets at the end of each period is 48.33%、47.78% and 44.95%, The balance of bad debt provision for accounts receivable is 3085.89 Ten thousand yuan 、2146.49 Million and $ 3497.54 Ten thousand yuan .

Tian Wangxing 、 Tian Ben and his son are the actual controllers

The actual controller of Yilian technology is Tian Wangxing 、 Tian Ben and his son , Tian Wangxing directly owns Yilian technology 24.51% shares , Tian Ben directly owns Yilian technology 10.21% shares ;

meanwhile , Tian Wangxing 、 Tian Ben passed Wang Xing industry 、 Shenzhen Benyun 、 Shenzhen Overseas Chinese friends 、 Xiamen Benyou indirectly holds the company 36.45% Shares of ; Tian Wangxing and Tian Ben directly and indirectly hold the company in total 71.16% Shares of .

From the perspective of controlling the proportion of voting rights , Tian Wangxing 、 Tian Ben is the actual controller of Wangxing industry and Shenzhen Benyun , Tian Ben is the executive partner of Shenzhen QIAOYOU and Xiamen Benyou , Tian Wangxing 、 Tian Ben can control Wang Xing industry 、 Shenzhen Benyun 、 The total voting rights of the company's shares held by Shenzhen QIAOYOU and Xiamen Benyou 46.72%.

Therefore, the proportion of voting rights that Tian Wangxing and Tian Ben can actually control the company's shares directly and indirectly is 81.43%.

During the reporting period , Tian Wangxing was appointed chairman of the company ; Tian Ben was appointed as a director of the company 、 The general manager .

Tian Wangxing , male ,1958 year 11 born , High school education .1996 year 12 Month to 2018 year 8 month , Ren, general manager of Wangxing industry ;1999 year 6 Month so far , Serve as the executive director of Wangxing industry ;2011 year 11 Month to 2016 year 8 month , Ren Yilian, chairman of the board of directors 、 The general manager ;2016 year 8 Month so far , Ren Yilian, chairman of the board of directors .

Tian Ben , male ,1985 year 11 born , Graduated from the University of Southampton , Management major , Master degree .2011 year 11 Month to 2016 year 8 month , Ren Yilian, technology supervisor ;2016 year 8 Month so far , Ren Yilian, director of science and technology 、 The general manager .

IPO after , Wang Xing industry holds shares of 27.3%, Tian Wangxing's direct shareholding is 18.38%, Tian Ben's shareholding is 7.66%, Changjiang chendao holds shares of 6.76%, Zhuoxiangyu holds shares of 3.42%, Shenzhen QIAOYOU holds shares of 3.31%, Chengqingfeng's shareholding is 3.07%, Shenzhen Benyun holds shares of 2.87%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person , If reproduced, please indicate the source .

边栏推荐

- Using virtual serial port to debug serial port in keil MDK

- Perceptron of machine learning

- 专业“搬砖”老司机总结的 12 条 SQL 优化方案,非常实用!

- Biden signs two new laws aimed at strengthening government cyber security

- Token processing during API encapsulation

- OpenVINO CPU加速调研

- Sikulix select the picture of relative position (advanced version)

- Using pictures to locate app elements sikulix

- Zhongshanshan: engineers after being blasted will take off | ONEFLOW u

- mysql如何将字段修改为not null

猜你喜欢

![Front and back management system of dessert beverage store based on SSM framework dessert mall cake store [source code + database]](/img/1b/9060d58d4dbb7f6f3c3a58959b7f14.png)

Front and back management system of dessert beverage store based on SSM framework dessert mall cake store [source code + database]

Simulation Keil et vspd

网站存在的价值是什么?为什么要搭建独立站

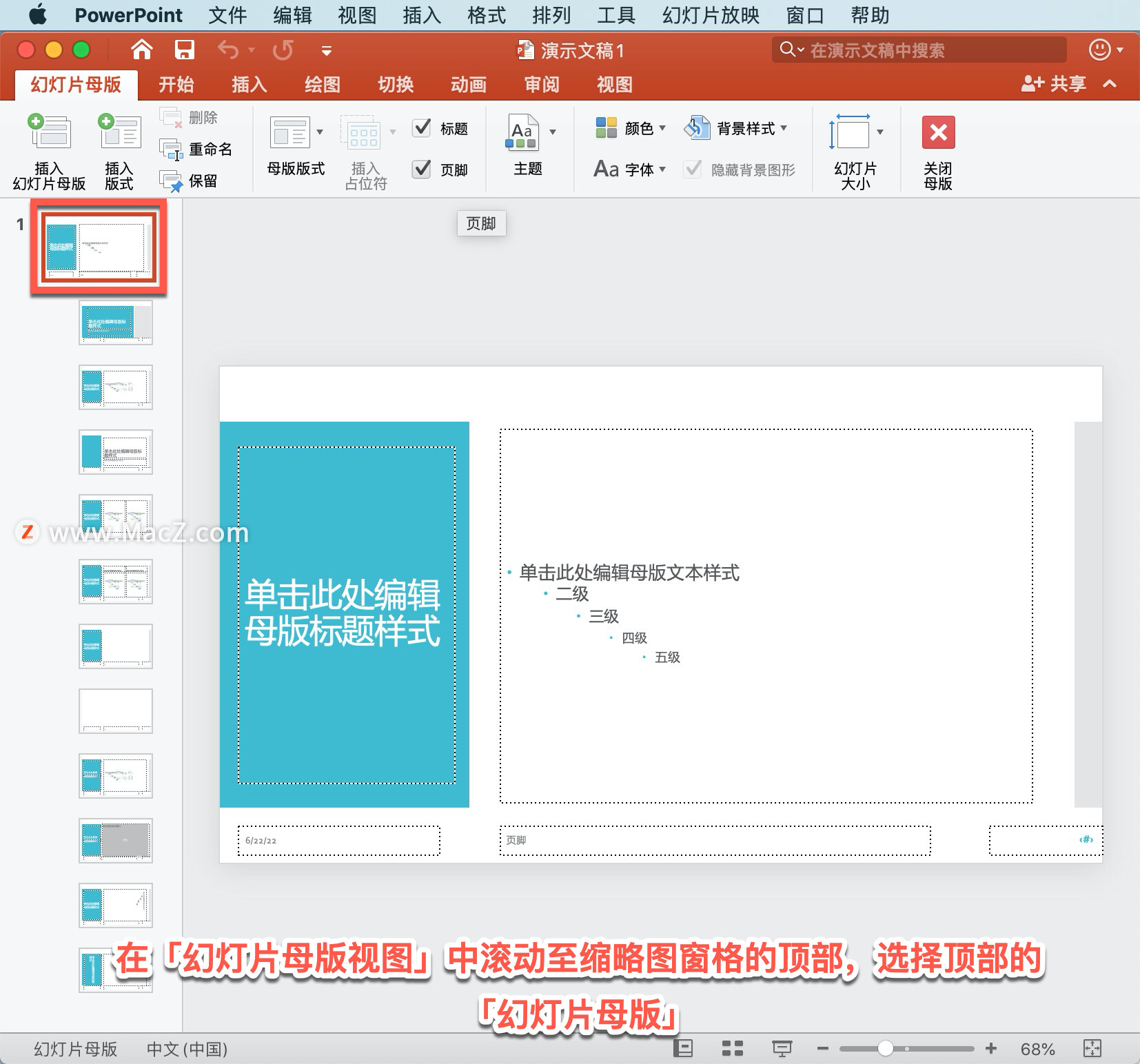

PowerPoint tutorial, how to add watermarks in PowerPoint?

【直播回顾】战码先锋第六期:共建测试子系统,赋能开发者提

What is the value of a website? Why build an independent station

Database connection pool: stress testing

Software architecture

封装api时候token的处理

求求了,别被洗脑了,这才是90%中国人的生存实况

随机推荐

封装api时候token的处理

C language student management system (open source)

Le modèle de diffusion est encore fou! Cette fois - ci, la zone occupée était...

Detailed explanation of CSAPP Labs

visual studio开发过程中常见操作

FreeRtos 任务优先级和中断优先级

Biden signs two new laws aimed at strengthening government cyber security

PHP built-in protocols (supported and encapsulated protocols)

【毕业设计】基于半监督学习和集成学习的情感分析研究

Please, don't be brainwashed. This is the living reality of 90% of Chinese people

同花顺如何开户?在线开户安全么?

Are there many unemployed people in 2022? Is it particularly difficult to find a job this year?

Struggle, programmer -- Chapter 46 this situation can be recalled, but it was at a loss at that time

Front and back management system of dessert beverage store based on SSM framework dessert mall cake store [source code + database]

Fight, programmer chapter 43 kill one man in ten steps

After 100 days, Xiaoyu built a robot communication community!! Now invite moderators!

U++ operator learning notes

keil MDK 中使用虚拟串口调试串口

Open source SPL redefines OLAP server

Error: unable to find a match: lrzsz