当前位置:网站首页>Tianrun cloud is about to be listed: VC tycoon Tian Suning significantly reduces his holdings and is expected to cash out HK $260million

Tianrun cloud is about to be listed: VC tycoon Tian Suning significantly reduces his holdings and is expected to cash out HK $260million

2022-06-22 13:48:00 【Bedouin Finance】

6 month 21 Japan , Tianrun cloud (HK:02167) Open the offering , The offering date is 2022 year 6 month 21 solstice 6 month 24 Japan . According to the plan , Tianrun cloud predicts 6 month 30 Listing on the Hong Kong Stock Exchange . CICC is its sole sponsor .

according to the understanding of , Tianrun cloud plans to sell all over the world 4350 Thousands of stocks (2400 Ten thousand new shares +1950 Ten thousand old shares ), among 90% For international sale 、10% For public sale , have other 15% green shoe , The bid price per share is at 12.85 HKD to 13.85 Between Hong Kong dollars , The highest fundraising 6.02 Million Hong Kong dollars .

performance ,2019 year 、2020 Years and 2021 year , The revenue of Tianrun cloud is 3.35 One hundred million yuan 、3.54 Million dollars 4.02 One hundred million yuan ; Net profit ( Profit for the year ) Respectively 5914.5 Ten thousand yuan 、7016.7 Million and $ 1781.8 Ten thousand yuan , The total comprehensive income during the year was 5958.6 Ten thousand yuan 、7025.9 Million and $ 1797.1 Ten thousand yuan .

By contrast , Tianrun cloud 2020 Year on year growth in net profit 18.6%, and 2021 In, it fell sharply year-on-year 74.6%, The scale of profits has been greatly reduced . meanwhile , The net interest rate of the company ( Net interest rate ) from 2019 Year of 17.7% to 2020 year 19.8%, and 2021 In, it dropped to 4.4%.

source : Tianrunyun prospectus .

During the reporting period , The gross profit margin of Tianrun cloud is 46.6%、49.6% and 45.5%. For the decline of gross profit margin , Tianrun cloud explained in the prospectus that , Mainly because of its anticipation 2021 In the second half of the year, customer demand will continue to grow and more Telecom resources will be purchased ( Including the phone number 、 Dedicated leased lines and Internet broadband ).

Tianrun cloud also says , because COVID-19 epidemic situation , The business of the company's customers will be adversely affected , And the business performance of the company will be affected . According to the current situation and the current information , Tianrun cloud forecast and 2021 Compared with the annual growth rate , On 2022 Revenue growth will slow in .

According to the Consulting Report , On 2021 Annual income , Tianrun cloud is the largest provider of public cloud customer contact solutions in China , The market share reaches 10.3%.2021 year , The company has promoted more than... Between the enterprise and its customers through multiple channels 30 Billion voice calls 、 Interaction in the form of SMS and text chat .

Bedouin found that , Unlike most companies , There are also old shareholders selling shares in the listing of Tianrun cloud , That is, some shareholders have substantially reduced their holdings , I know this -W(HK:02390) It is similar when listing on the Hong Kong Stock Exchange in the form of dual main listing . among , I know that listing on the Hong Kong stock exchange does not offer new shares , Instead, old shareholders sell shares .

According to public information , Innovation Works 、 Qiming venture capital 、 Saifu 、 Today's capital is sold separately 750 Thousands of stocks 、325 Thousands of stocks 、325 Thousands of stocks 、1200 Thousands of stocks . Calculated according to the selling price at HKEx , Innovation Works 、 Qiming venture capital 、 Saifu 、 Today's capital is expected to be “ Cash out ”2.40 Million Hong Kong dollars 、1.04 Million Hong Kong dollars 、1.04 Billion Hong Kong dollars and 3.85 Million Hong Kong dollars .

According to settlement , The four old shareholders who sold their shares reduced their holdings by about 8.23%, The corresponding shareholding ratio decreased to about 7.28%、7.24%、5.69% and 1.05%. For all that , The founder of Zhihu 、 Chairman and CEO Zhou Yuan still said “ We believe that , We will be more confident to dig deep into the content track , Get more recognition from friends ”.

For Tianrun cloud , The selling shareholders at the time of this listing are Fortune Ascend Holdings Ltd.. According to introducing , The company was founded by Wisdom Extra Limited hold 94%, and Wisdom Extra Limited It is wholly owned by Tian Suning . among , Tian Suning is the founder of AsiaInfo technology (HK:01675) Co founder 、 Chairman and executive director of the board of directors .

Public information display , AsiaInfo Technology Co., Ltd 2018 year 12 month 19 Listing on the Hong Kong Stock Exchange , The issue price is per share 10.5 The Hong Kong dollar / stocks . Besides being the leader of AsiaInfo Technology , Tian Suning is also the broadband capital of private equity companies (China Broad bandCapital Partners, L.P.) Founder and Chairman , a “VC bosses ”.

As early as before Tianrun RONGTONG, the predecessor of Tianrun cloud, was listed on the new third board , Beijing Tianchuang Chuang run investment center controlled by Tian Suning ( Limited partnership ) Has become a shareholder of Tianrun RONGTONG , Up to 41.83%, Tianshuning indirectly holds Tianrun RONGTONG 38.89% Equity of .

source : Tianrun RONGTONG prospectus .

At the same time , Legal representative and chairman of Tianrun RONGTONG 、 Wuqiang, the general manager, holds shares 29.23%. And the latest prospectus shows , Before tianrunyun landed at the Hong Kong Stock Exchange , Executive director of Tianrun cloud 、 Chairman of the board 、 CEO Wuqiang passed Xinyun Inc.、EastUp Holding Limited Share holding 25.0%、15.0%, Total shareholding 40.0%.

by comparison , Controlled by Tian Suning Fortune Ascend Holdings Ltd. Shareholding 24.63%. According to the prospectus , After Tianrun cloud was listed , The total shareholding ratio of Wuqiang is 34.48%, Total control 49.72% The right to vote ;Fortune Ascend Holdings Ltd. The shareholding ratio of 10.01%, Drop by more than 50%.

By the median of the issue price (13.35 The Hong Kong dollar ) Calculation ,Fortune Ascend Holdings Ltd. The amount of reduction reached 2.60 Million Hong Kong dollars . however , Listed companies in Australia Platinum、 The sound network of NASDAQ listed companies Agora(NASDAQ:API) As cornerstone investors, they respectively subscribe 1.18 Million Hong Kong dollars 、6280.16 Million Hong Kong dollars , Total subscription is about 1.808 Million Hong Kong dollars .

source : Tianrunyun prospectus .

After listing ,Platinum、Agora The shareholding ratio of Tianrun cloud is 5.08%、2.70%. Assuming that the over allotment rights are fully exercised , The shareholding ratio of the two is 4.90%、2.61%.

边栏推荐

- 155. Min Stack

- Stephencovey's tips for efficient work for young people

- Leetcode interval DP

- HMS core news industry solution: let technology add humanistic temperature

- 别再用 System.currentTimeMillis() 统计耗时了,太 Low,StopWatch 好用到爆!

- Linux setting enables Oracle10g to start automatically

- Ppt data collection methods and analysis skills

- Leetcode daily question 202110

- 简简单单的科研秘籍

- Instanceinforeplicator class of Eureka (service registration auxiliary class)

猜你喜欢

leetcode 99. Restore binary search tree

leetcode-区间dp

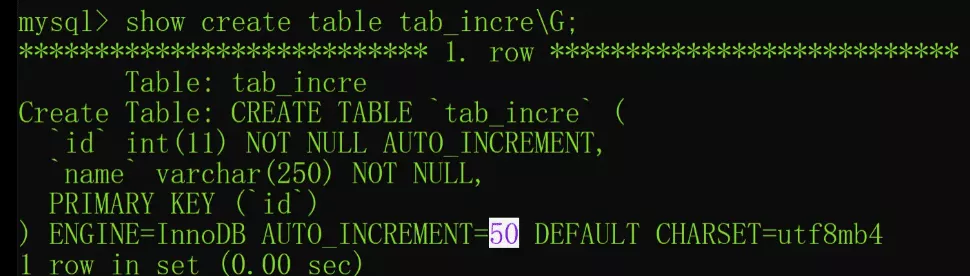

MySQL如何让一个表中可以有多个自增列

HMS core news industry solution: let technology add humanistic temperature

Opengauss database source code analysis series articles -- detailed explanation of dense equivalent query technology

JSP based library management system, including source code, database script, video tutorial for project operation, and video tutorial for thesis writing

防火墙基础之策略部署

My suggestions on SAP ABAP transformation

leetcode 85. Max rectangle

openGauss数据库源码解析系列文章—— 密态等值查询技术详解

随机推荐

Uninstall MySQL 8

Interaction between awk language and Oracle database for nearly half a year

Detailed installation tutorial of MySQL 8.0.29 under windows to solve the problem that vcruntime140 cannot be found_ 1.dll、plugin caching_ sha2_ password could not be loaded

性能相关指标

"N'osez pas douter du Code, vous devez douter du Code" notez une analyse de délai de demande réseau

Instanceinforeplicator class of Eureka (service registration auxiliary class)

程序员要不要选择软件人才外包公司?

Starting Oracle under Linux

leetcode-背包问题

epoch_ Num and predict_ Conversion of num

338. Counting Bits

VCIP2021:利用解码信息进行超分辨率

MySQL如何让一个表中可以有多个自增列

leetcode 834. Sum of distances in the tree

力扣每日一练之双指针2Day9

Oracle user space statistics

"Dare not doubt the code, but have to doubt the code" a network request timeout analysis

hw在即,你还不会看危险报文?

数据库 就业咨询系统求各位帮下忙

谈谈人生风控