当前位置:网站首页>Development of trading system (V) -- Introduction to Sinovel counter

Development of trading system (V) -- Introduction to Sinovel counter

2022-06-25 03:59:00 【Tianshan old demon】

One 、 Sinovel platform brief introduction

1、 Hua Rui platform brief introduction

The current institutional business is rising 、 The transformation of wealth management of securities companies is in full swing , Sinovel financial technology provides an integrated unified access gateway 、 Institutional trading system 、 Real time risk control platform 、 High speed market 、 Transaction bus 、 Develop and test cloud services and other functions , From planning to implementation , From design to implementation , From software to services , The overall delivery solution of institutional transaction risk control from hardware to link .

The overall solution of Sinovel institutional transaction risk control is as follows :

2、 Low latency

The essence of competitive trading is price priority 、 Time first competitive transactions . Whether the entrusted declaration of traders can be successfully reached , In addition to the commission price , The time delay of offer is the biggest influence factor , It is also the first element to judge the trading system capability of securities companies from the perspective of investors .

Investor perceivable trading delay , It consists of two parts: the processing delay of the securities trading system and the processing delay of the exchange , Exchange delay is the same for all market investors , The time delay at the broker end plays a decisive role . The delay at the broker end is divided into uplink delay and downlink delay , Uplink delay refers to the time when the entrustment enters the securities trading system , Time delay from leaving the offer service to submitting to the exchange gateway , The uplink delay is the key to determine whether the entrustment can be delivered to the exchange as soon as possible .

ATP The uplink delay of the extreme deployment scheme can be as low as 30 In microseconds , It is a veritable ultra-low delay and high-speed trading system , And the delay stability can be expected , It will not fluctuate violently due to the change of entrustment pressure .

3、 High concurrency

Institutional investors have a high degree of automation , Instantaneous concurrent delegation is high , The total daily Commission is huge , There are very high requirements for the throughput capacity and commission capacity of the trading system .

The handling capacity of securities trading system is usually entrusted TPS To express , That is, the number of delegates processed per second . The time delay index must be the same as TPS The combination of indicators is meaningful , That is to say, the delay in negotiation must be made clear under what entrustment pressure , And talk about entrustment TPS It must also be clear what delay level is reached . Due to the inevitable existence of transaction concurrency , The time delay recorded by declaring only one consignment is of little practical significance , The delay index should be evaluated under different concurrency pressures . And because of the competitive nature of the deal , There is no point in not ensuring the throughput at the delay level , It can only indicate that the system is not down , But the service quality has been unqualified .

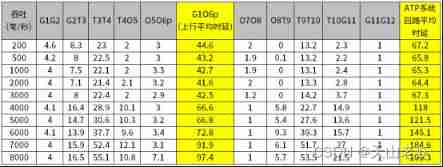

Hua Rui ATP The measured data of a single transaction node in the express version :

3000 pen / Second Commission pressure , Average uplink delay <45 Microsecond , Loop delay <70 Microsecond .

8000 pen / Second Commission pressure , Average uplink delay <100 Microsecond , Loop delay <200 Microsecond .

4、 Horizontal expansion

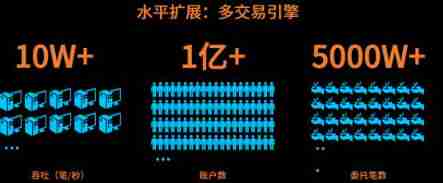

As a distributed trading system ,ATP Ability to scale horizontally ,8000 pen / Seconds is just the best cost performance capacity of a transaction node , Not Sinovel ATP The limit of capacity .

When more capacity is required , Every time 1 platform PC Servers can be added 1 A trading node , Get the corresponding capacity increase , And the performance level does not decrease . By expanding , The whole system can support more than at ultra-low delay level 10 Ten thousand brush / Second delegate request , And there is no need to modify the application software , It can be realized only through operation and maintenance configuration .

5、 Flexible deployment

Geographical distance has a very significant impact on the trading speed of investors , It is even easy to introduce extra delay of tens of milliseconds , The impact is particularly serious in the third-party access scenario .

ATP Support flexible two node and two nearby high availability deployments , A highly available transaction node can be deployed in Shanghai and Shenzhen respectively . Two securities accounts under the same investor , You can offer from two places nearby , It meets the demand of Shanghai and Shenzhen for the ultimate speed of offer .

ATP Although it supports the deployment of multiple transaction nodes , But it belongs to the same trading system , It can be monitored uniformly 、 Unified management 、 Unified operation and maintenance .

6、 Transaction channel management

Trading channels are important resources ,ATP Multi transaction node and multi-channel mode , Support careful calculation of transaction channel resources 、 Flexible configuration management requirements .

Channel exclusive mode , Each trading engine can be configured with an exclusive trading channel , Exclusive resources , The trading channels do not affect each other .

Due to the restriction of the exchange offer gateway on the flow rate , A separate transaction channel may not meet the requirements of concurrent entrustment ,ATP It also supports the ability of the same trading engine to connect multiple trading channels , Easily realize channel expansion .

Through these flexible configuration modes , Securities companies can choose which service model to provide for investors , Multiple investors can share a trading channel , Or a single investor can monopolize a channel , Multiple investors can share multiple trading channels , It is also possible for a single investor to use multiple trading channels , Very flexible and convenient .

7、 Real time risk control ARC

Institutional business attaches great importance to risk control ,ARC(ArchForce Risk Control, Sinovel real-time risk control platform ) It is a real-time risk control product tailored for institutional trading business , It is especially suitable for building real-time risk control and global risk control capabilities for business scenarios such as third-party access , It can help securities companies quickly establish a comprehensive system that meets the requirements of three-party access risk control 、 Real time risk control capability of the whole process , Fully meet the compliance monitoring and risk management requirements of securities companies for institutional transactions .

ARC Based on distributed platform , Using parallel computing technology , Equipped with microsecond real-time risk control engine , Meet the transaction speed requirements , The real-time massive calculation of real-time risk control for the transaction of the adaptation institution needs , The daily calculation amount can reach 10 billion times , Ensure that risks are identified and discovered at the first point in time .

ARC Design intelligent monitoring model following the regulatory requirements , From the regulatory rules 、 Penalty cases 、 Supervision letter , Analysis based on a large number of transaction behavior data 、 Repeat 、 Calculation 、 modeling , Strive to make the rule model accurate and effective .ARC It can provide integrated closed-loop institutional transaction risk management for securities companies , Through complete process design 、 Functional design , Provide one-stop service for system users , Users do not need multiple systems to switch constantly .

8、 Unified access gateway

In order to meet the unified access of the third-party transaction information system 、 Unified risk control requirements , Sinovel is based on ATH(ArchForce Trading Highway , Sinovel high speed transaction bus ) Launch unified access gateway , Data communication 、 Protocol adaptation 、 Access control, transaction push and other functions .

Sinovel unified access gateway adheres to the concept of openness and compatibility , Both provide standards API Access , And compatible with existing FIX、KCXP/KCBP、AR/AS/T2 And so on , Support securities companies PB System 、 Quantitative trading system and other systems are directly connected to , Support information investment 、 Mainstream transaction clients such as tongdaxin , It can quickly and conveniently meet the access of third-party systems , Protect the existing investments of investors and securities companies to the greatest extent .

Sinovel unified access gateway also provides a variety of identity authentication 、 Safety measures for flow control , Support flow control for individual or total connections of each user , User delegation is supported 、 cancel the order 、 Query and other operations are used for flow control , Completely satisfied 《 Provisional regulations 》 Medium to customer 、 System verification requirements .

The unified access gateway is designed in multi active mode , Interface protocol and API Provide breakpoint alignment mechanism for return data , Support failover and automatic reconnection . At the same time, the unified access gateway can realize grouping according to the fund account , So as to realize the horizontal expansion of system capacity .

9、 High speed market

Quotation service is an important service provided by securities companies for institutional customers . As a trigger for trading signals , The market speed determines the trading speed , The service quality of market data is an important measure of the service quality of institutional business .

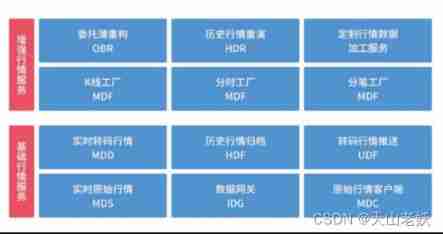

AMD It is a new generation of enterprise level market service platform of Sinovel , Focus on real-time market distribution and market data processing , Provide microsecond market distribution and market enhancement services for financial institutions . Can be used for distribution within the data center 、 Distribute across data centers 、 Various scenarios such as remote end users .

AMD With cascading distribution 、 Priority forwarding 、 Real time monitoring and other functions , Be able to provide streaming market at the same time 、 File Market and other different markets 、 Distribution services for different types of market data , Moreover, different distribution strategies of delay priority or bandwidth priority can be provided for users according to the use environment , So as to provide different levels of data centers for users 、IDC Computer rooms and sales departments at all levels provide fast 、 Stable original quotation distribution service .

AMD Provide rich data interfaces , It can provide the market data in the original format of each exchange , There can be a variety of API Push market data in form . In addition to providing raw market data ,AMD Excellent scalability , Extend the components of deep processing of emotion in a modular way on demand , Provide query and replay services of historical market data , Generate K Line Market 、 Time sharing market 、 More abundant data forms such as individual quotations . Through the deduction of transaction by transaction entrustment and transaction by transaction market ,AMD It can simulate the reconstruction of the order book status of the exchange , Provide more reference information for institutional investors .

AMD With great flexibility 、 Extremely low switching cost 、 Full scalability can meet the needs of different market participants for market data .

10、ATH Transaction bus

In order to better serve institutional customers , Transaction data should be able to be collected and shared in real time , To facilitate the development of more institutional service capabilities .

ATH Focus on the transaction data transmission of securities companies , Realize unified access of different terminal systems , Support the service integration related to transaction data in the background .

ATH It can connect with various data sources to collect data , Support multi-dimensional data subscription , Provide high efficiency for terminal system 、 Fast transaction data distribution and push service . With excellent performance and horizontal scalability , Reduce data source access pressure , Ensure the safe and stable operation of the core system .

ATH be based on AMI And frame structure , Support flexible business expansion , Improve the independent development ability of securities companies , Users can customize the development according to their own business needs .

11、 Develop and test cloud environment

《 Interim Provisions on external access management of trading information system of securities companies 》 Article 13 requirements “ Before securities companies provide investors with external access services to the trading information system , A simulation test environment consistent with the production environment should be established ”. Before the access of the third-party transaction information system is officially launched , Securities companies need to verify the access system , Make sure it can run stably , Verify procedural transactions 、 Algorithmic trading meets expectations , And simulate and test the abnormal conditions , Strictly control business and operational risks . But it is a very complicated work to establish a simulation environment consistent with the production system according to the requirements , User management 、 Application deployment 、 Test verification 、 The workload of transaction simulation is huge , Hardware investment is also a big expense .

Sinovel associates with industry cloud organizations , It provides application for developing and testing cloud resources for securities companies and investors 、 Deployment upgrade 、 Operation management 、 Technical support 、 One stop service for test management , Provide a complete cloud testing environment for third-party access , And docking with the exchange and other simulation test environment , Equipped with test quotation 、 Simulation matchmaking 、 Automated testing and other tool chains , It greatly reduces the burden of securities companies , It's a major 、 A complete full-service simulation test platform .

Two 、 Hua Rui ATP Counter

1、ATP brief introduction

ATP(ArchForce Trading Platform, Sinovel core trading platform ) Focus on the exchange floor standard business , Connect order management system and exchange trading system , The business scope covers all kinds of floor trading , Provide transaction order generation 、 Front end risk control inspection 、 Offer and other functions , And transaction management 、 Operation and clearing functions .

ATP The product follows the hierarchy 、 abstract 、 decoupling 、 Isolated business design philosophy , The public technical service framework and configurable transaction business framework are implemented , Business features are encapsulated as independent business packages , Realized “ Can be assembled ” Type business configuration , Effectively isolate the interaction between businesses , It can be assembled and launched in batches as required , The scope of influence can be effectively controlled during business adjustment .

ATP The product has a scalable and elastic architecture , It can be flexibly applied to build a large-scale centralized trading system used by ordinary investors according to scenarios 、 The institutional trading system for professional investors and the high-speed trading system for extreme performance scenarios .

2、 characteristic

High availability : All components are highly available , There is no single point of failure risk in the whole system ; Multi active cluster , Second level automatic switching in case of failure , There is no need for human intervention ; Support remote disaster recovery , Minute level switching can be realized ; Messages and business data are all persistent .

High performance : stay 50 Ten thousand brush / Second ultra-high throughput , Core transaction processing delay as low as 3 Microsecond ;

Support multi transaction node deployment , Realize the nearby offer of each exchange .

Horizontal expansion : Realize linear capacity expansion by adding servers , Can accommodate more than 1 Billion securities account ;

Capacity expansion is transparent to applications , Operation without risk ; Business packages are assembled on demand , Go online in batches , The risk of business change is small .

3、 ... and 、 Hua Rui AMD The market

1、AMD brief introduction

In procedural trading , The market speed determines the trading speed .

AMD(ArchForce Market Data, Sinovel high speed market platform ) It is an enterprise level market service platform , Based on the new generation distributed architecture technology , Provide microsecond market distribution services for financial institutions , Focus on real-time market distribution and market data processing . It supports high-speed transcoding in the same data center 、 Fast original distribution , It also supports cross data center deployment , It is suitable for multi scenario applications of financial institutions .

2、AMD Product advantage

Stable and reliable : Double active and double source , Two way merge , Ensure that the market is not interrupted ; Real time hot standby , There is no single point of failure risk in the whole process , Automatic failover ;L2+L1 Market downgrade backup ,L2 Switch to when the market source is abnormal L1 The market .

Low latency : Microsecond distribution delay ; Two way merge to select the fastest market .

Unlimited expansion : The market bus can be connected to an unlimited number of market user nodes ; Adopt reliable multicast technology , Save bandwidth , At one point , Multi point simultaneous delivery ; Horizontal expansion + Vertical cascade .

3、AMD Product features

Multi dimensional quotation subscription : market + data type ( Such as snapshot 、 One by one 、 Announcement, etc )、

Portfolio ( predefined )、 negotiable securities ( Dynamic definition )

Enhance market service : Accurately repeat the historical market of any day ; High speed 、 accuracy 、 Keep the order ; Provide quotation processing services such as commission Book reconstruction .

Data completion mechanism : Auto completion mode ; User completion mode ; Mixed completion mode .

Open interface : Provide simple and easy-to-use standards API Interface

Centralized operation and maintenance management : Centralized monitoring ; Visual operation and maintenance ; One click upgrade rollback

边栏推荐

- 2D 照片变身 3D 模型,来看英伟达的 AI 新“魔法”!

- Google founder brin's second marriage broke up: it was revealed that he had filed for divorce from his Chinese wife in January, and his current fortune is $631.4 billion

- The problem that only the home page can be accessed under openSUSE Apache laravel

- Preparedstatement principle of preventing SQL injection

- Tencent's open source project "Yinglong" has become a top-level project of Apache: the former long-term service wechat payment can hold a million billion level of data stream processing

- 中国天眼发现地外文明可疑信号,马斯克称星舰7月开始轨道试飞,网信办:APP不得强制要求用户同意处理个人信息,今日更多大新闻在此...

- opencv怎么安装?opencv下载安装教程

- 扎克伯格最新VR原型机来了,要让人混淆虚拟与现实的那种

- Crawler grabs the data of Douban group

- 威马招股书拆解:电动竞争已结束,智能排位赛刚开始

猜你喜欢

(ultra detailed onenet TCP protocol access) arduino+esp8266-01s accesses the Internet of things platform, uploads real-time collected data /tcp transparent transmission (and how to obtain and write Lu

俄罗斯AIRI研究院等 | SEMA:利用深度迁移学习进行抗原B细胞构象表征预测

JSP cannot be resolved to a type error reporting solution

《悉达多》:一生之书,可以时常反刍

北大换新校长!中国科学院院士龚旗煌接任,15岁考上北大物理系

可能是拿反了的原因

Amazon's other side in China

opencv怎么安装?opencv下载安装教程

吴恩达机器学习新课程又来了!旁听免费,小白友好

【Harmony OS】【ARK UI】ETS 上下文基本操作

随机推荐

Wechat development related

孙武玩《魔兽》?有图有真相

佐喃社区

Tensorflow, danger! Google itself is the one who abandoned it

Wuenda, the new course of machine learning is coming again! Free auditing, Xiaobai friendly

AI自己写代码让智能体进化!OpenAI的大模型有“人类思想”那味了

俄罗斯AIRI研究院等 | SEMA:利用深度迁移学习进行抗原B细胞构象表征预测

Jilin University 22 spring March "career design" assignment assessment-00072

Maybe it's the wrong reason

“语法糖”——我的编程新知

Work assessment of Biopharmaceutics of Jilin University in March of the 22nd spring -00005

马斯克被诉传销索赔2580亿美元,台积电公布2nm制程,中科院发现月壤中含有羟基形式的水,今日更多大新闻在此...

Lao Ye's blessing

Musk was sued for $258billion in MLM claims. TSMC announced the 2nm process. The Chinese Academy of Sciences found that the lunar soil contained water in the form of hydroxyl. Today, more big news is

【Rust投稿】从零实现消息中间件(6)-CLIENT

PHP代码审计1—PHP.ini的那些事

[rust submission] review impl trail and dyn trail in rust

Jilin University 22 spring March document retrieval assignment assessment-00073

【组队学习】SQL编程语言笔记——Task04

Musk: Twitter should learn from wechat and make 1billion people "live on it" into a super app